About Jupiter – JLP Pool

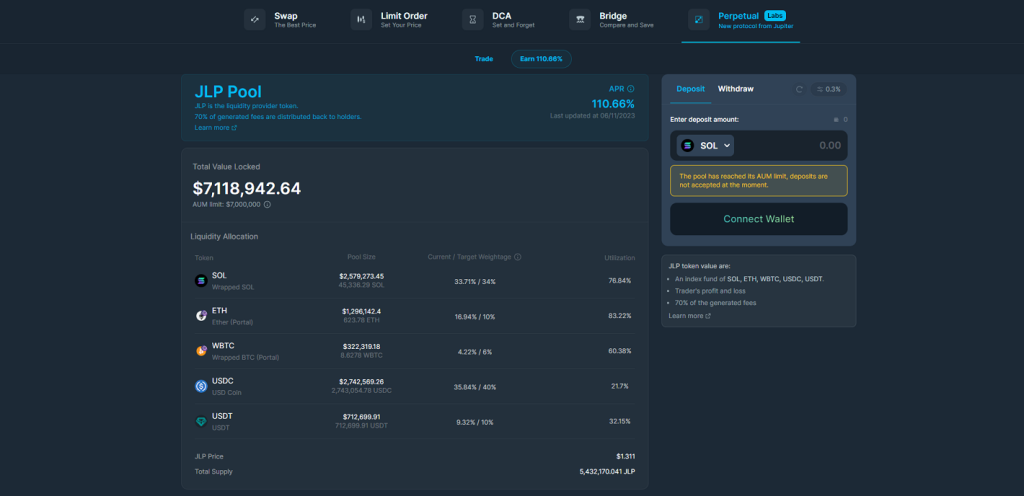

At Breakpoint 2023, JupiterExchange, the leading DEX Aggregator on Solana, unveiled several significant enhancements for the platform. Notably, they introduced perpetual trading, utilising a liquidity pool instead of the conventional order book model where market makers are necessary. This system enables users to contribute liquidity and earn from trading fees and activity. Currently, the attractive 110.66% APR has garnered a TVL (Total Value Locked) exceeding $7 million.

How Do I Get Involved?

Liquidity providers can deposit any asset, even if it is not among the predefined tokens in the pool (SOL, ETH, WBTC, USDC, or USDT). In such cases, the deposited asset is exchanged for whichever tokens are below their target weightage. In return, users receive $JLP tokens, representing their share in the pool. The value of each $JLP token is determined by dividing the Total Value Locked (TVL) by the total supply of $JLP. You can withdraw your stake from the pool at any time by exchanging your $JLP tokens for the asset of your choice or by selling them directly once trading is live.

Pool earnings are generated from 70% of all fees including:

- Position opening and closing fees

- Borrowing/funding fees

- Pool deposit and withdrawal fees

Fees are compounding into the pool hourly.

Holders do not earn value through rewards that get airdropped or claimed. Instead, fees contribute to the growth of the pool, thereby increasing the value of the $JLP token.

In addition to this, the pool values will fluctuate as trades are made. Winning trades will draw on liquidity from the pool whilst losing trades will act as contributions to the pool. The specific mechanisms involved has been elaborated here.

Considerations

Pool Performance

The pool operates on a shared outcome principle, where participants experience both gains and losses collectively. When a trader incurs a loss, the pool grows, and conversely, when a trader succeeds, the pool contracts.

The underlying strategy relies on the premise that the combined fees and gains from losing traders surpass the losses from winning traders, as reflected in the current APR calculations.

This brings up concerns that a series of big wins could lead to the value of the pool being wiped out quite quickly, but this potential is not as aggressive as you might think for a couple reasons:

- Maximum Trade Size: Each individual trade is capped at $125K USD, limiting the impact of substantial wins or losses on the pool.

- Token Utilization Cap: A utilization percentage cap is imposed on each individual token. For instance, in a SOL leverage long, where SOL is borrowed from the pool, a maximum of 90% of the pool’s SOL can be borrowed at any given time. Once this limit is reached, further SOL borrowing is restricted.

- The Leverage System also functions as a hedge for the pool. The specific mechanism is covered here.

Considering these safeguards, the perceived risk of the pool being rapidly depleted is not as pronounced as initially anticipated.

Platform Utilisation

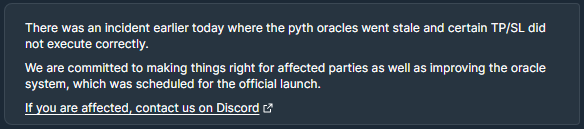

The pool’s successful performance hinges on trading volume. Currently, the 24-hour total volume is $58 million, translating to $41K for the pool at a 0.1% trading fee with 70% allocated to the pool. This figure will naturally vary over time, emphasising the importance of Jupiter enhancing the UI/UX to attract traders. Recent challenges with the oracle have led to issues with stop losses and take profits being missed, resulting in losses for users. Addressing these issues is crucial for attracting volume to the platform. That being said, the platform is still very much in its alpha phase and improvements will naturally come with time.

Impermanent Loss

Deposits and withdrawals are valued in USD. If a non-stablecoin token is deposited, the withdrawn amount of that token may not match the initial deposit.

For instance, depositing 10 SOL at $50 each results in $500 worth of $JLP. If SOL later rises to $75 while the $JLP maintains its value, the withdrawal will yield only 6.66 SOL.

The ‘Index Fund’

An intriguing aspect of $JLP is its operation similar to an index fund, mirroring the value movements of SOL, BTC, and ETH. When these cryptocurrencies appreciate, the overall pool value increases, leading to growth for $JLP. Conversely, depreciation in these assets has a corresponding impact. In the screenshot provided in the about section, the pool’s limit is $7 million, yet the TVL currently stands at $7.12 million, reflecting recent surges in token values. Notably, ETH’s weightage exceeds its target due to a 12.5% increase yesterday.

The concept offers a unique approach to capital allocation, providing a distributed risk model. For instance, directing capital towards SOL during a pump could be optimal, but it exposes investors if SOL experiences a downturn. $JLP addresses this by allowing long-term bullish exposure to SOL, ETH, and BTC, with the added benefit of earning rewards from the platform’s exchange. It’s crucial to understand that the strategy’s impact is moderated by the leverage system, where the quantity of SOL, ETH, and BTC can fluctuate based on the utilization rate and trade outcomes, as explained in detail here.

Deposit/Withdrawal Fees

Fees associated with depositing and withdrawing from the pool are contingent on the target weightage of each asset.

For deposits:

- Depositing an asset surpassing the target weightage incurs deposit fees.

- Depositing an asset below the target weightage results in reduced or zero fees.

- If depositing a token not in the pool, it will be exchanged for the asset with a lower weightage than the target to minimize fees.

For withdrawals:

- Withdrawing an asset exceeding the target weightage entails lower or zero fees.

- Withdrawing an asset below the target weightage incurs fees.

- If withdrawing in a token not in the pool, the algorithm selects the token with a higher weightage than the target and swaps it to the desired token to minimize fees.