Introduction

Breakpoint 2023 brought about a series of major announcements from one of the household names on the Solana Ecosystem – Jupiter. One such announcement was the introduction of perpetual futures on the platform allowing leverage trading.

Exchange Model

Diverging from traditional centralised exchanges, the platform operates without an orderbook model, negating the necessity for market makers to provide liquidity in the conventional manner. Instead, the Pyth Oracle is employed to monitor and track price movements.

The JLP pool facilitates leverage trading by allowing traders to borrow the necessary assets for leveraged positions. A comprehensive explanation of the JLP pool system can be found here.

This carries significant implications. Firstly, when engaging in trading on a conventional exchange, closing a long position necessitates having adequate liquidity available.

For instance, closing a position at a take profit of $50 requires a enough long orders at that specific price. In certain scenarios, price movements can be rapid, leading to quick rejections from a level. Consequently, even if the take profit is reached, the position may not be entirely closed.

The utilisation of the oracle entirely mitigates this potential issue. In a similar scenario where the price hits the take profit but swiftly wicks down, the entire position will be filled without any resulting price impact.

Secondly, this means that substantial orders executed on the exchange do not influence the price. You can initiate a sizable position at a specific price point without inducing market movement. The only constraints are the individual trade cap and utilisation caps set by the exchange as follows:

- Max individual position size = $125K

- Max percentage utilisation of pool asset = 90%

The Leverage Hedge

A recurring concern, including my own, was the possibility of a series of significant wins depleting the JLP pool. The question arose: Could a sequence of major victories rapidly exhaust the funds if winning trades draw on the pool’s liquidity?

The potential impact of this concern is not as dire as one might anticipate, and here’s why:

In traditional leverage trading, going long involves borrowing USD/FIAT to purchase an asset expected to appreciate. Upon selling for a profit, you repay the borrowed amount + fees and retain the difference. Conversely, shorting entails borrowing the asset, selling it, buying back at a lower price, and keeping the profit.

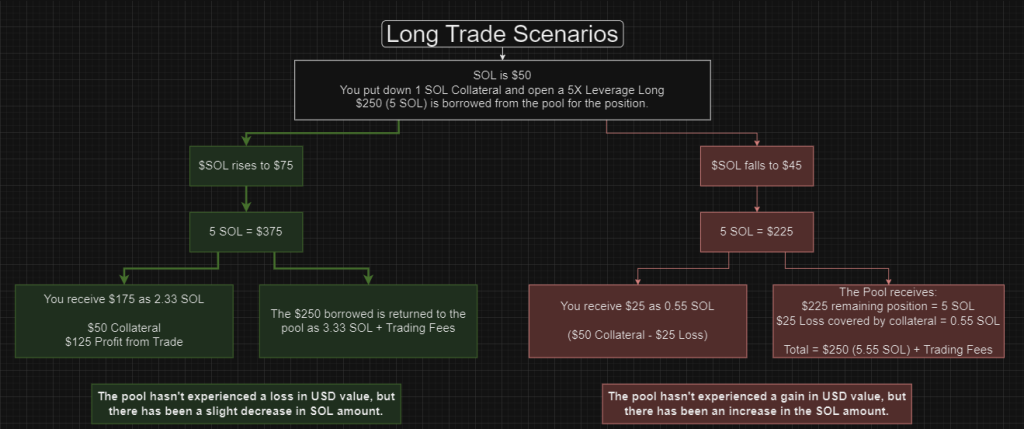

Jupiter’s system reverses this process. When taking a long position, you borrow the asset you are longing. For instance, in a long on SOL, Jupiter lends you SOL for that specific position. Consequently, if your prediction is correct and SOL’s value appreciates, your winnings are offset by the appreciation of the borrowed SOL, incurring no additional cost to the pool. While the pool loses a small amount of SOL, its stability from a USD standpoint is maintained.

This mechanism is illustrated in the image below displaying hypothetical scenarios. The green boxes represent a winning trade scenario, while the red boxes depict a losing trade scenario.

Shorts function similarly, except you are borrowing a stablecoin. This is outlined in the image below.

Future Development

While this platform represents innovation in providing positive user experiences for decentralised trading, there is still significant progress to be made. It’s important to note that their Perpetual Futures trading platform is in the early alpha stages, and users should be aware of potential bugs, engaging at their own risk.

Recent challenges with Oracles going stale have led to issues with unexecuted TP and SL orders, resulting in losses. Despite the team’s efforts to rectify these issues, there is ongoing work, and I have enormous confidence in the Jupiter team’s ability to deliver high-quality products in the future.