Introduction

We’ve all seen these kinds of images being shared on social media as traders celebrate/flex their wins. Whilst there is nothing wrong with celebrating victories, I am going to explain why, in isolation, sharing these cards is utterly useless.

An enormous lack of context is the primary issue.

Establishing Context – What DO We Know?

So let’s start with what we can interpret from these cards.

- Ticker – what trading pair was it?

- Direction – long or short?

- Amount of Leverage

- % Move

- Entry Price

- Last Price

So there’s a couple key points to note here:

1 – The % move includes the leverage amount factored in. Whilst that may seem obvious, people forget to take that into account. In the example above, a 117.38% move on 11x leverage is actually a 10.67% move. That’s still capturing a nice trade, don’t get me wrong.

What I often see is people will have 100x leverage on and be celebrating a 10% move when in actuality, the real move was 0.1%.

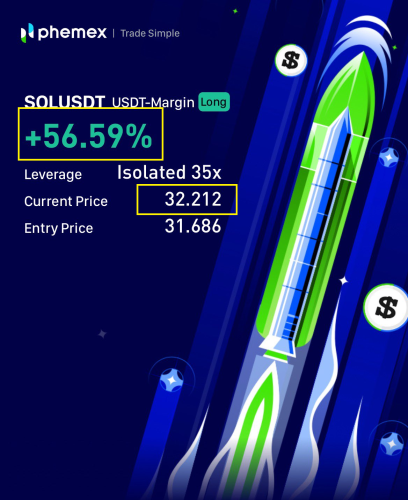

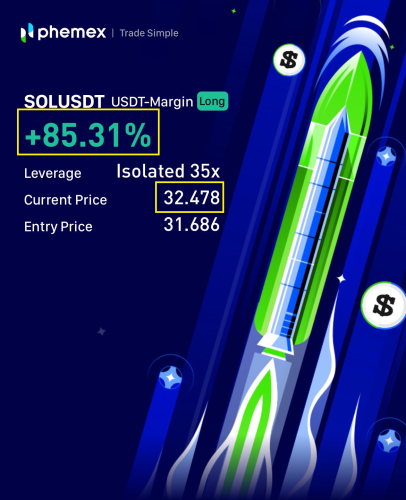

Here’s a practical example to show just how easily skewed this can be:

These two screenshots were shared 4 minutes apart. Notice the difference in price and the substantially larger difference in PnL percentage. A 26.6 cent change in price made the percentage increase by 28.72.

To be clear, this is not a knock on the person who shared this. This was purely just a good example of how quickly the percentages can look a lot better than what reality reflects.

2 – The cards display the entry and last prices, not the closing price. It’s essential to remember this. These cards are shareable while the trade is open, meaning the trader may not have taken profit or closed the trade. Until the position is closed, nothing is certain. The trader might boast about their position being up, but there’s still a risk it could turn against them, which they will rarely mention.

So What Context Is Lacking?

Position Sizing

This is significant. The actual capital a trader has invested matters greatly, both psychologically and practically. There’s a substantial difference between a $1 and a multi-thousand-dollar position. One could easily open a trade for a mere 10 cents on 100x leverage and boasting of over 1000% gains. In reality, their actual profit amount is negligible but you won’t know unless they disclose it. Genuine trades require skin in the game which brings its own challenges.

Risk Management

This ties into the position sizing point as well. I want you to take a look at the image below and tell me which trade is actually better?

If you are using proper risk management, the trade on the left is better because of the setup creating a more favourable risk-reward ratio.

When used correctly, risk to reward is the ratio between how much money you would lose if you got stopped out versus how much you would gain if the trade plays out.

Let’s say hypothetically that my trade plan is that I risk a maximum of $100 on a trade. In other words, when I set-up my trade, it is done so that if the stop loss is hit, the most I lose is $100.

The trade set-up on the right does capture a larger percentage move than the one on the left, but because my stop loss range is also large, the amount I can put on the trade is going to be less.

If the trade on the left plays out, I will win $594 for the $100 I’ve risked. If the trade on the right plays out, I will win $247 for the $100 I’ve risked.

The point to grasp here is that the percentage move alone does not indicate how much profit you actually made.

Trade Rationale

Why did you enter where you did? Where is your take profit set at and why? Where is your stop loss set at and why?

If this information is not shared with me, your trading flex card is worthless from a value perspective. As I stated before, anyone can just open a random position for a miniscule amount, get lucky and then start flexing like they’re a genius.

What is valuable is sharing an understanding of how you set your trade up. THAT is how I determine if you are a legitimate trader or not. THAT is how I determine if it is worthwhile paying attention to what you are doing.

To give you an idea of the standard I like to see, check out this ongoing trade breakdown that our esteemed Professor has been updating. Everything you need to know about his trade rationale and set-up is laid out for you and is actually useful information.

Setting a New Standard

Unfortunately the reality is that people who get enticed by these PnL cards simply don’t know any better. They lack the understanding to recognise important information being completely neglected.

What I would like to see become the standard is something like the image below. The trade set-up itself is visible (albeit, the cropping isn’t ideal on this example), the RRR is clear and the actual account growth is shared. Props to the team at Vema Trader for leading the way with this approach!

I’d be very surprised if exchanges adopted such a model because these just don’t look as sexy as enormous percentage gains. As such, it is up to us to recognise what is important and see through the deceptive marketing.