This is more than just an economics lesson; it’s a story of the U.S. navigating the treacherous waters of debt and deficit, contrasted with the rising tide of digital currencies. As the government leans on the printing press, we explore the implications of this debt-driven strategy and the growing trend of investors finding refuge in the digital domain.

Picture this: The U.S. is like a shopper on a spree at the debt store, grabbing loans left, right and center. In just three years, America’s deficit ballooned to a whopping $9 trillion, with 60% of that coming from the Federal Reserve’s enthusiastic money printing.

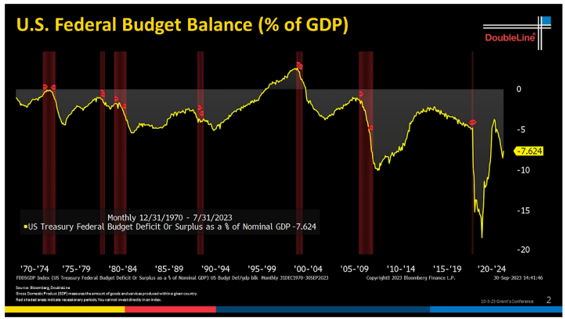

Remember the days of surplus at the start of the 21st century? Well, that ship has sailed. When economic storms hit, like the 2020 Covid-19 crisis, the U.S. went all out, printing money like there’s no tomorrow to keep the economy afloat. Now, the deficit is chilling at nearly 8% of GDP, ironically matching the “growth” in 2023. Without this governmental generosity, the U.S. economy might have been playing a game of freeze tag.