NFTFi with Sharky Part 1: Introduction

JUP Victory

Following its selection as one of the first two projects to debut on Jupiter’s LFG Launchpad, attention is now shifting to SharkyFi’s platform, with users eager to leverage the forthcoming token launch. For newcomers, this four-part series will guide you through the fundamental aspects of navigating Solana’s leading NFTFi platform.

Once you have that under your belt, fellow Skribr author will take you through the points system and how to farm for the $SHARK token in his article here.

Market Dominance

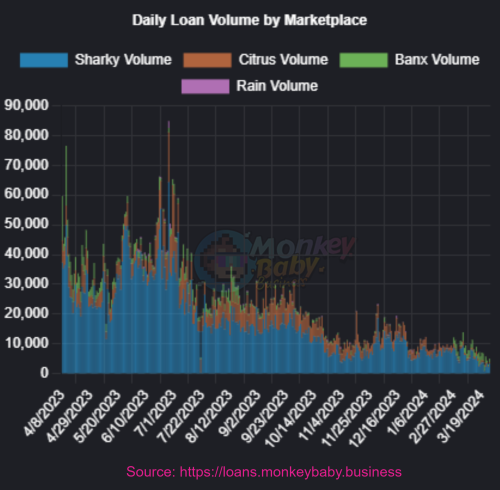

Since launching over two years ago, SharkyFi has become a leading force in Solana’s NFTFi sector. Their consistent dominance of the market is illustrated in the graphic below from Monkey Baby Business.

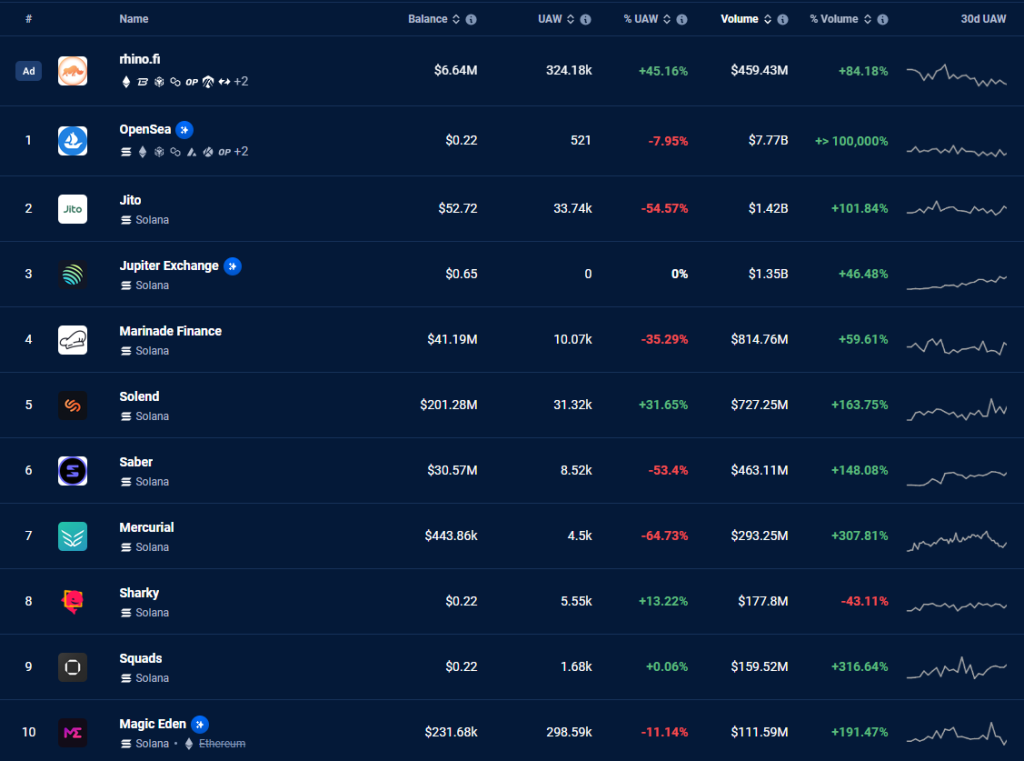

Beyond their loan market dominance, they also rank in the top 10 most used dApps by volume over the past 30 days, despite a 43% decrease in volume, as shown below.

Image taken from dApp Radar

The platform features an exceptionally intuitive UI, simplifying the process for lenders to invest their capital and for borrowers to quickly obtain liquidity against their NFTs. Part 4 of this series discusses the various reasons and strategies available and can be found here.

NFTFi

NFT holders frequently confront the challenge of asset illiquidity. While some view this as an inherent feature of NFTs, others support their financialisation. This series will not debate the merits of these differing perspectives but will instead highlight a specific product in the Solana Ecosystem.

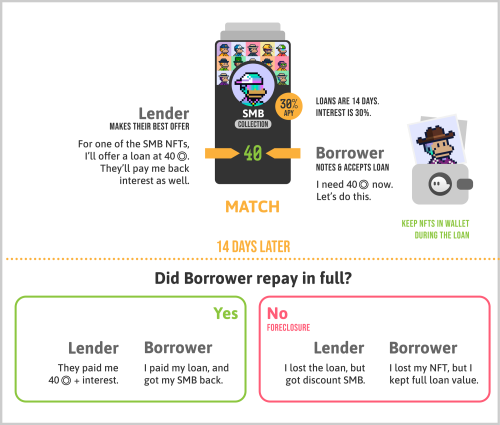

SharkyFi operates as an escrow-free loan service, enabling lenders to earn interest on their SOL or potentially secure an NFT at below-market prices.

Conversely, borrowers gain fast and immediate liquidity for various ventures. Some borrowers have also been known to hedge their positions. This will be discussed in more detail in Part 4 of this series.

This function is illustrated in the image below taken from Sharky’s Bitepaper.

Part 2 of this series will look into navigating the UI for Lenders.