Introduction

The recent surge in Decentralized Finance (DeFi) on the Solana blockchain has propelled MarginFi to the forefront of borrowing and lending protocols, boasting a Total Value Locked (TVL) exceeding $300 million.

Since the launch of their points system in July, coupled with a series of airdrops, there is growing anticipation of an impending MarginFi airdrop. Interested users can farm points on MarginFi to potentially benefit from this airdrop here.

The Points System

MarginFi’s points system rewards user engagement within its ecosystem, incentivizing both volume and duration of activity. Points can be accrued in the following ways:

- Lending – at a rate of 1 point per $1 per day

- Borrowing – at a rate of 4 points per $1 per day

- Referrals – earn 10% of the points earned by your referrals.

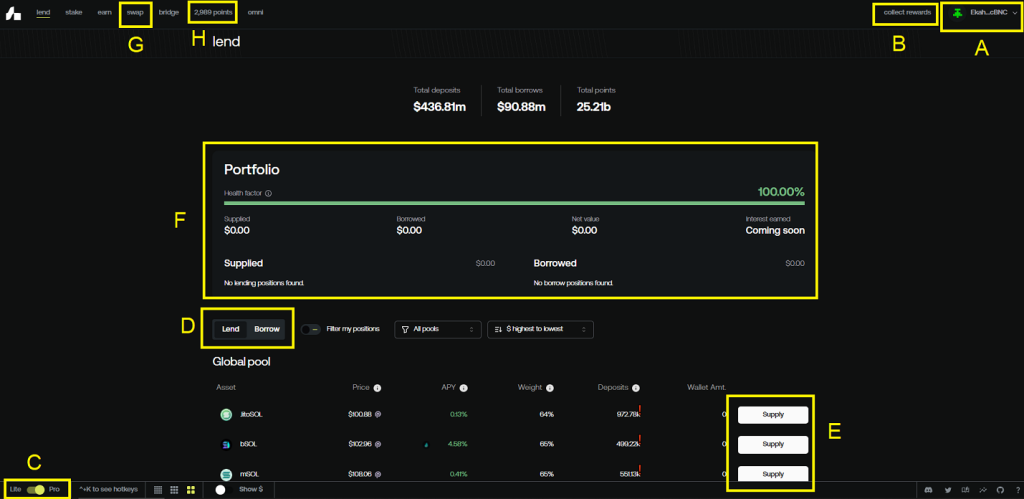

User Interface

A – Wallet Connect

B – Collect Rewards. Borrowing/Lending certain assets earns you additional rewards from other protocols which can be claimed here

C – Lite/Pro Mode Toggle. This guide will be using Pro Mode

D – Lend/Borrow Toggle

E – Borrow/Lend Position Setup

F – Portfolio Tracker

G – Swap Platform powered by Jupiter

H – Points

Step 1: Lend

For the purposes of this example, we are going to lend SOL. The assets you choose to lend and borrow will depend on a combination of assessing the APYs as well as your risk strategy. This has been outlined in more depth in this article.

Step 2: Borrow

You will then borrow the asset of your choosing by toggling the interface over to borrow and selecting your asset.

Step 3: Loop

You can then use MarginFi’s Swap feature to swap your borrowed asset back into the originally lent asset. The perk of this feature is that it is powered by Jupiter so it gives you the added benefit of farming for future $JUP airdrops.

You can then loop the asset back into lending and cycle as you see fit.

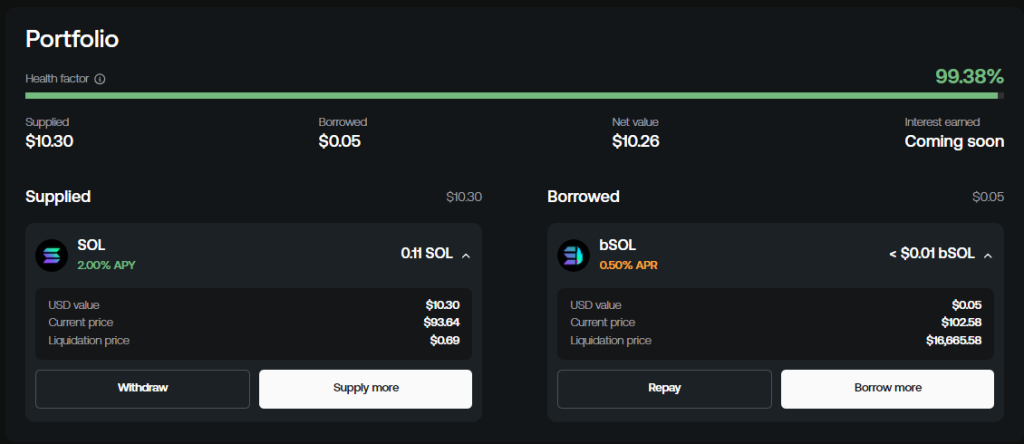

Manage Position

Finally, manage your position through MarginFi’s simple portfolio tracker. Key elements you want to be monitoring are the health of your position and the liquidation prices.

Considerations

Risk management is also essential with any strategy and the referenced Loop Lending article outlines the main considerations.

It is also important to note that when the airdrop meta kicked off, MarginFi was one of the first protocols users flocked to. One may note when looking at the points leaderboard that attempting to reach a meaningful position at this point is a gargantuan effort. Whilst it is absolutely worthwhile to get at least some exposure on the board, many users believe that the opportunity has already been diluted down. You are encouraged to make your own assessment.