Introduction

Kamino’s Automated Liquidity Vaults aim to streamline DeFi engagement by tackling common challenges:

- Strategy Selection: How to define and set optimal ranges.

- Volatility and Impermanent Loss: Effective management techniques.

- Manual Operations: Simplifying rebalancing, yield harvesting, and compounding.

The Solution

Kamino aim to address these challenges through three key features provided by their Automated Liquidity Vaults.

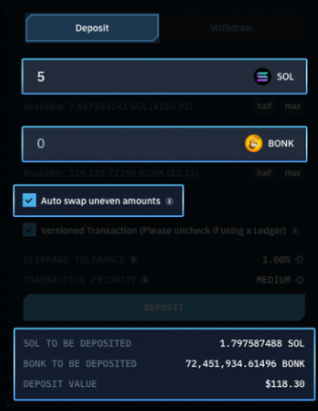

Auto-Swap

Similar to Orca, this feature lets you specify the amount you want to deposit for each asset, and the platform automatically executes a swap to maintain the necessary deposit ratios.

You can set the withdrawal proportion for each asset, and the platform will automatically perform a swap to achieve this balance.

Auto-Compound

Unlike other platforms that require manual harvesting and reinvestment of rewards, Kamino automates this process. A bot monitors your position every 15 minutes and, if your earnings exceed 10 cents, it automatically harvests and compounds the rewards.

Auto-Rebalance

Every 20 minutes, a bot checks the current price against the set range. If the rebalance criteria are met, it triggers a process to withdraw funds, identify a new range, and redeploy funds at the required ratio. The specific criteria for rebalancing are proprietary.

It is important to note that this process does not prevent impermanent or divergence loss. Any loss accumulated up until that point will be realised.

The Platform

The platform generates revenue through fees on every deposit and withdrawal. Additionally, it earns performance-based fees, where a percentage of the profit from fees and rewards is paid to Kamino. The fee structure varies across individual vaults, reflecting their complexity.

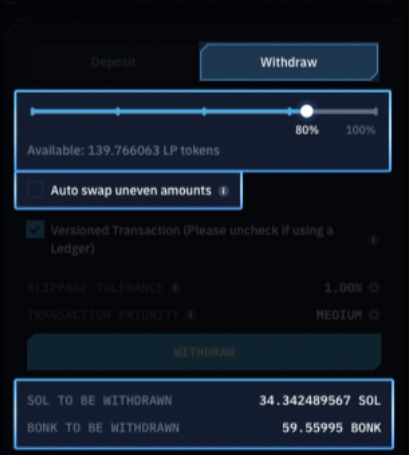

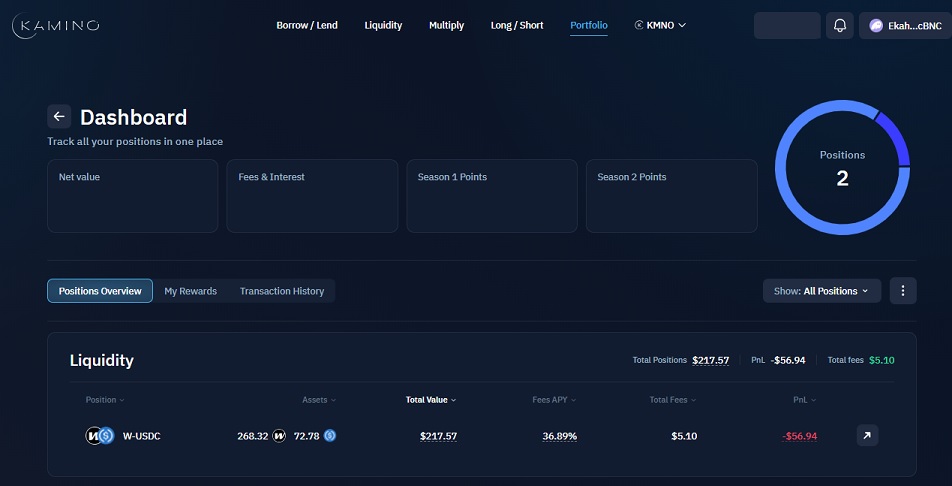

Liquidity Dashboard

Navigating to the Kamino Liquidity Page will land you as per the image above.

At the top menu, highlighted by a red box, is the ‘Portfolio’ section summarizing your positions.

Pools can be accessed using the search function or by browsing the categories shown in the blue box.

Hover over a pool’s 7D APY to see a detailed breakdown of the fees’ origins, indicated in the yellow box. Pools marked with a lightning symbol offer additional token rewards, such as $W and $JTO. Those with the Meteora logo qualify for earning MET points.

The right column displays the platform each pool operates on.

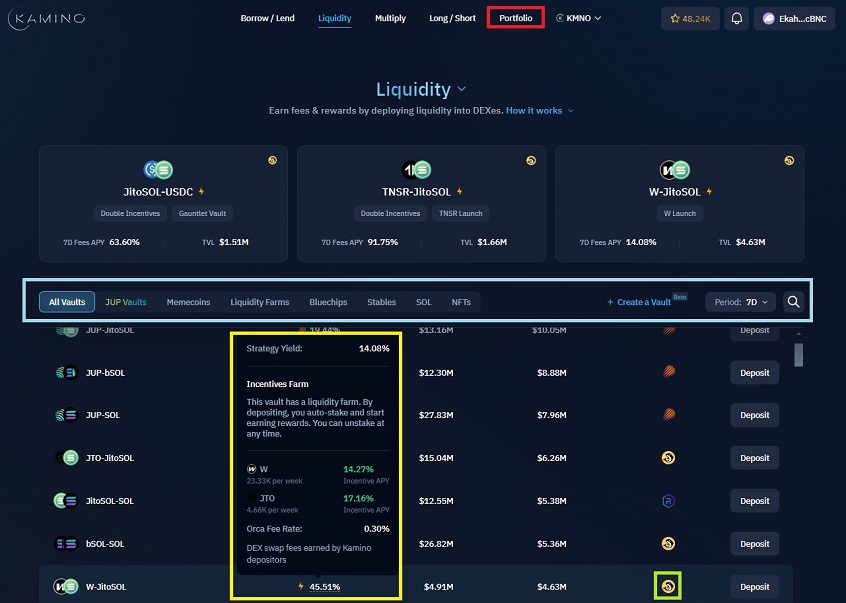

Depositing Into a Position

Select ‘Deposit’ on the pool of your choosing to be taken to the following page.

On the right side of the Kamino Liquidity Page, you can set the parameters for your deposit. By selecting ‘Single-Asset Deposit,’ you can deposit using just one asset, and an automatic swap will occur for the other asset to achieve the required ratio.

It’s important to pay attention to the position range displayed on the bottom left. If you prefer a tighter range you will need to do this yourself on a different platform.

Across the top of the page, you’ll find options to monitor your position and view analytics provided by Kamino.

The analytics page offers transparent comparisons between the performance of Kamino pools and hypothetical HODL scenarios. This analysis sometimes demonstrates that participating in a liquidity pool is not always more profitable than simply holding your assets.

Position Management

Kamino offers an aesthetically pleasing dashboard for monitoring your positions. The dashboard displays all positions along with their Annual Percentage Yield (APY) and fees earned. It also provides a Profit and Loss (PnL) figure that compares the current value of each position to its value at the time of deposit.

For more detailed management, you can click into individual positions. This section allows for further deposits and withdrawals.

Conclusion

Kamino has developed a simple and low-maintenance system for users interested in participating in DeFi. However, it’s important to understand that this ease of use—where responsibility is relinquished—also means reduced control over your investments. Despite the automation, having a well-considered strategy remains crucial.