Introduction

DeFi has transformed the financial landscape, empowering individuals to engage in asset financialisation through activities like borrowing, lending, and trading.

Automated market makers and liquidity pools facilitate trading beyond the constraints of traditional centralised exchanges whilst also rewarding participants who contribute their liquidity.

Before you proceed, we strongly recommend gaining a foundational understanding of liquidity pools and automated market makers, including how they function. Fortunately, Whiteboard Crypto provides excellent explainer videos, available at the following links:

What is an Automated Market Maker?

The Flaw In the System

Liquidity is essential for trading. Each transaction, whether a purchase or sale, requires the pool to have adequate liquidity to facilitate it. Insufficient liquidity leads to price impacts, resulting in significant price fluctuations which is unappealing to traders.

Traditional automated market makers (AMMs) suffer from inefficiency because they require vast amounts of liquidity to stabilise prices. Why is this the case?

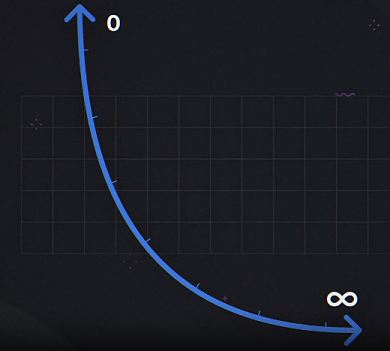

The graph demonstrates that in a traditional liquidity pool, liquidity is distributed across a price scale from zero to infinity, shown on the X-axis, with the Y-axis indicating the number of tokens available at each price.

This wide distribution is impractical for most assets because it results in a significant portion of your liquidity remaining inactive. Prices are unlikely to hit these extreme levels, meaning much of the liquidity does not actively contribute to market dynamics. This distribution dilutes the effectiveness of the liquidity, requiring larger total amounts to achieve the desired price stability.

The Solution

Enter concentrated liquidity.

This innovative approach to liquidity pools enables providers to allocate their capital within specific price ranges of their choosing, instead of spreading it across the entire spectrum from zero to infinity. This method offers several benefits:

- Increases capital efficiency by focusing liquidity in ranges where trading is more likely to occur.

- Reduces dormant liquidity, ensuring that more of your capital is actively involved in market activities.

- Enhances the potential to capture more trading fees relative to the amount of capital invested.

- Helps minimise price impact by maintaining more stable and predictable pricing within the chosen ranges.

Capital Efficiency

The image below, taken from Uniswap, illustrates the improvement in capital efficiency as liquidity becomes increasingly concentrated.

This approach is particularly beneficial for correlated assets with minimal volatility. For instance, barring a significant depegging event, USDC and USDT should trade at or very close to a 1:1 ratio. Therefore, when providing liquidity to a USDC/USDT pool, it is inefficient to deposit across a full range curve, given the unlikely price swings.

Similarly, in the case of an mSOL/SOL pool, aside from a major depegging event, the price of mSOL relative to SOL typically appreciates at a consistent rate. Consequently, it is more logical to set tighter liquidity ranges around the current price level, optimising capital usage and reducing unnecessary exposure to price fluctuations.

Concentrated liquidity can also be effective for more volatile assets; it simply requires strategic range setting. An image from Uniswap, shown above, highlights the differences in capital efficiency between two users. This visual underscores how carefully chosen liquidity ranges can significantly impact the effectiveness and profitability of investments, even in markets with higher price fluctuations.

BUT

As with anything, there are important risks and considerations that must be taken into account and they relate to how you set your ranges – or more specifically – what happens when price moves outside of your range.

Let’s go back to this previous example:

In this hypothetical scenario, where the image depicts an ETHUSDT liquidity pool with a set price range from $250 to $12,000, your liquidity remains active only while ETH trades within this range. If price leaves the range, your funds will become inactive.

- If price appreciates above $12000, you will only be holding USDC as all your ETH will have been sold for price to move up.

- If price moves below $250, you will only be holding ETH as all your USDC has been used to buy ETH.

Essentially, when the price moves outside your range, you end up holding the ‘less favourable’ asset. If the price continues to drop, you hold a depreciating asset, increasing your risk of losses. Conversely, if the price rises above your range, you miss out on potential gains because you no longer have exposure to the asset’s appreciation.

This effect is essentially an amplification of impermanent loss.

This is where your strategy becomes crucial. If you are long-term bullish on ETH, you might not mind accumulating more when prices are low. In fact, you could use liquidity pools as a method to dollar-cost average (DCA) into more ETH, which you could then withdraw in anticipation of a price increase. Context and strategy is always key.

The Balancing Act

As is the case with most things, there is a balance to be found.

What considerations might you take into account when setting your ranges?

- Volatility of the asset – ranges are always going to be your friend in these endeavours. If price is trending, you will expose yourself to more impermanent loss. Setting your ranges with some technical analysis guiding it is a useful exercise.

- What is the asset? – the previous example used an ETHUSDT pool where you might be ok accumulating more ETH long term. What about a memecoin though? Are you comfortable bag holding if that eventuates?

Conclusion

DeFi continues to be a highly innovative area as we aim to reduce our dependence on traditional financial institutions. The introduction of concentrated liquidity marks a significant advancement in enhancing capital efficiency. For liquidity providers, this system offers the opportunity to maximise fees earned from their efforts but also introduces risks. It’s crucial to consider both aspects when developing a strategy.