Introduction

Recent Solana Ecosystem airdrops have significantly influenced user behavior, leading them to gravitate toward DeFi platforms to enhance eligibility for upcoming drops. Activity is a key determinant for eligibility, and employing loop strategies through borrowing and lending presents a straightforward method to boost activity in relation to one’s capital.

Considerations

In any strategy, context is crucial. Our primary goal is not to maximize APY returns but to stimulate activity on platforms, enhancing our chances of qualifying for an upcoming airdrop.

Considering this, it’s essential to note:

- Airdrops are not guaranteed a high value. This approach exposes us to potential opportunities, but their success is uncertain.

- With the above point in mind, we want to employ strategies that carry minimum risk so that if the airdrop isn’t worthwhile, we aren’t at a significant loss.

The Loop

It works like this, you deposit an asset (let’s call it A) onto the platform. Borrow asset B using the deposit of Asset A as collateral. Then use a platform like Jupiter to swap Asset B into Asset A. Then deposit Asset A as collateral and create the loop.

By following this loop, we are able to leverage our initial deposit and amplify our activity.

Strategy Considerations

With the above strategy, take into account the following:

- Volatility of Assets A and B

- The more the value of Assets A and B are correlated, the less volatility risk there is

- When selecting your assets, consider their recent price action and what it may do in the near future

- Lend APY vs Borrow APY

- Ideally you want the APY of the asset you are lending to exceed the APY of the asset you are borrowing. This will put you into a net positive interest.

- APYs are dynamic so be sure to keep an eye on them

- The more loops you do, your liquidation points will become tighter and your risk will increase

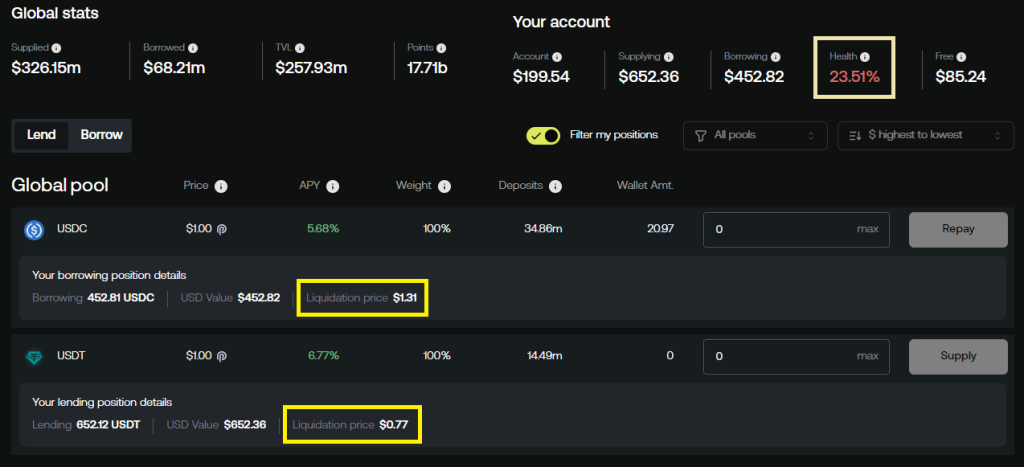

Platforms like MarginFi will provide an assessment of your ‘position health’ which reflects how at risk you are of liquidation. The lower the percentage, the higher your risk. Liquidation prices are also provided to tell you at what point your positions will be closed.

Platforms such as Kamino Finance will show this with a bar graphic. The closer you are to the white dot, the higher your risk of liquidation.

Conclusion

Borrowing and lending loops are a useful strategy for amplifying your activity on a DeFi platform to increase your odds of qualifying for an airdrop. As with any strategy, considerations must be taken into account in order to optimise your performance and reduce your risk.