Introduction

Financial freedom is a goal that many of us will pursue in our lives. Despite this, we severely underestimate how testing it can be and the risks involved. As the saying goes, a smart person learns from their own mistakes, but a wise one will learn from the mistakes of others. This article will explain some common roadblocks to investing success as well as propose some solutions. Let’s dive in!

1. Not Establishing Context

Context. Is. Everything. If you’ve been trading for a while, you might have come across the phrase ‘the trend is your friend’. Simply put, you want to identify where the momentum of the market is heading and trade with it, not against it. The key is to accumulate what has the buying power.

In the case of crypto, I personally identify it as the following:

- In an up-trending scenario, Bitcoin has the buying power. By trading alts against BTC, winning trades not only win you some more BTC, you also get the compounding effect of BTC’s value going up as well.

- In a down-trending scenario, you want to be accumulating USD (granted this may change with global conditions). As the price of assets like bitcoin depreciate, your USD will be able to buy more per USD.

- Sideways ranges are notoriously difficult to trade as there is no prevailing trend. What asset you choose to accumulate depends on whether you think we are in an accumulation or distribution phase.

Examples:

- NFTFI has become very popular in recent times, especially on Solana.

- If SOL is trending down, earning interest on loans may not be a suitable idea. Yes you’re accumulating SOL, but the value of that SOL is depreciating. It is unlikely that the amount of interest you are earning can offset the value lost in holding SOL. You may have been better off selling SOL and waiting for an opportunity to reaccumulate.

- If SOL is trending up, this may also not be a good context for lending. As SOL value increases against USD, we typically see NFT floor prices drop to reflect the USD value. Therefore you may find more loans going underwater in their SOL value which is not ideal.

- Lending strategies work best in a sideways accumulation phase. Any sidelined SOL can be put to use to keep accumulating SOL at a steady price in preparation for a potential uptrend.

- DeFi is very similar.

- Locking up your funds in an LP in a downtrend exposes you to depreciation of your locked up assets, impermanent loss which is exacerbated in a downtrend and depreciation of whatever token rewards you may be earning.

- In an uptrend, it may work reasonably well but impermanent loss also needs to be considered. With IL in play, you may have been better off just holding the underlying assets.

- DeFi works best where price is stable and there is plenty of trading volume happening.

- In the case of NFTs, many people do not fully understand what it is they are buying and expect the wrong type of project to do the wrong type of thing. Understanding projects and why we buy into them is something I’ve discussed in another article, The Project Valuation Miscalculation.

Solution: Make sure to understand the context you are operating in.

2. Fear of Missing Out (FOMO)

Let’s be honest, we’ve all been there and will often struggle to resist. When something is moving really fast and people around you are making money, it’s not unforgiveable that you would also want a piece.

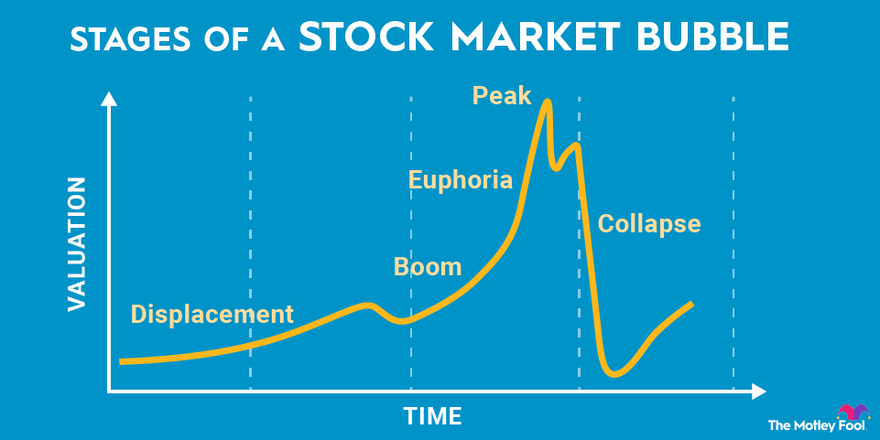

Statistically, by the time you cave into FOMO and pull the trigger, you are more likely to be buying close to the top of the move than the start. There is a point of diminishing return on how much is left in a big move, so why do so many people buy something that’s just done an enormous move just to try and catch that last little part? And that’s assuming that they take profit before it retraces which is inevitable. As for all those influencers shilling whatever it is they’ve made bank on? Don’t be their exit liquidity.

There is no doubt that not giving into FOMO will keep you out of what could have been some very profitable plays but you have to consider the other side. It will keep you out of significantly more losing plays.

There will always be more opportunities in the future. You don’t need to catch every single one.

Solution: Establish clear rules for entering a position to adhere to.

3. Not Managing Risk

How often have you seen people say something along the lines of ‘If X goes to zero, I’m done’. The truth is they had no business being ‘in’ in the first place. The psychological pressure of having to get your positions right is exponentially higher when you have more at risk.

Managing risk affords an investor the following:

- Minimise their losses in losing positions so they stay in the game for longer

- Minimise psychological effects of investing

Solution: Establishing rules for how you manage risk

One particular strategy that can work very well is the Minimax Strategy which I discussed in another article here.

4. Not Taking Profit

This is a huge one. How many of us have held an asset, watched it skyrocket, started thinking we are geniuses only to then watch it all come crashing down and end up bag-holding?

The NFT space is notoriously bad for this. When we consider that 99% of projects will fail and die, why do so many people not have strategies factoring this in? This doesn’t necessarily mean that you should aim to sell everything the moment your assets are in profit. You can certainly have conviction in a play and look to have something to hold in case your convictions are correct.

What it means is also having a strategy to take profits whilst holding your position to reduce your exposure. By reducing your exposure, you also remove psychological roadblocks to how you manage yourself. Speaking from experience, being risk-free on a position significantly reduces stress that can be brought about by market swings.

Solution:

A handy strategy is the rule of threes. As the name suggests, it involves buying in threes with each NFT serving a different purpose:

- One to flip for profit to try and recoup your initial outlay

- One to flip in case the project moons

- One to hold so you can take profit without exiting the project entirely if you wish to stay in the community.

Where you don’t have the luxury of buying in sets of three, having pre-determined levels to take profit and then sticking to them is also very useful.

Conclusion

Looking through these roadblocks, you may notice a common theme. Lack of strategy and the adverse effects this may have on psychology. You can be the best analyst in the world but a lack of strategy and poor psychological management will inevitably lead to your downfall.