Introduction

Airdrop season is well and truly underway on Solana with users looking for the next platform that could provide them with an injection of liquidity. One such platform is Kamino Finance, a multifunctional DeFi platform offering services such as borrowing and lending, liquidity pools and much more.

It’s crucial to note that airdrop performance is purely speculative, with no guarantees of how they will perform. Participation is key. This guide emphasises minimal-risk strategies, prioritising platform engagement for exposure to airdrops rather than chasing high APYs. In the worst-case scenario of airdrops being worthless, these strategies aim to minimize potential losses.

For the purposes of this guide, we will be employing a loop strategy which has been outlined in another article here.

What Do You Need To Get Started?

- Phantom Wallet browser extension. If you haven’t got it already, we have a handy guide to help you get started here.

- Some $SOL in your wallet to cover gas fees. Gas fees are minimal on the Solana blockchain (we’re talking fractions of cents) so you don’t need exorbitant funds for gas.

- Funds to deploy onto the platform depending on your strategy

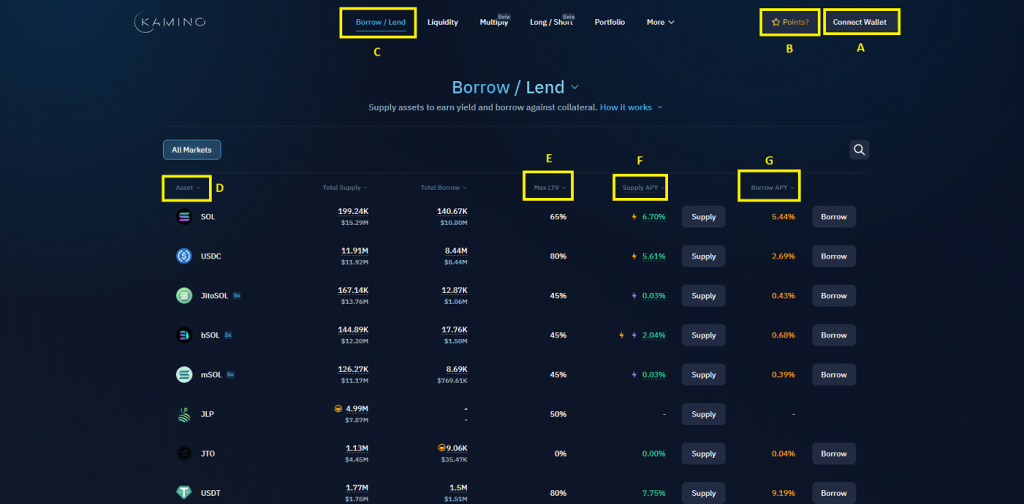

Step 1: The Interface

Now that you’re ready, let’s have a quick look at the interface.

A – Connect your Phantom wallet by clicking here.

B – This is what leads us to believe that there will be an airdrop. Previous airdrops have been preceded by users earning points based on activity and receiving tokens based on their points. The points system isn’t live yet for Kamino but it’s on its way.

C – Stick to Borrow/Lend for simplicity in utilising Kamino’s DeFi services; explore other options at your discretion.

D – Explore available assets for borrowing/lending.

E – Max LTV indicating the maximum borrowing percentage against provided collateral, often reflecting asset risk.

F – Supply APY. The interest you will earn for lending the asset

G – Borrow APY. The interest you will pay for borrowing an asset

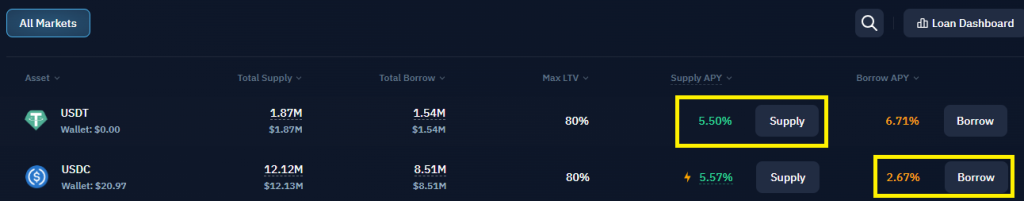

Step 2: Identify Assets for Loop

For this exercise, we’ll provide USDT and borrow USDC. The rationale is based on identifying a higher earning APY for lending USDT compared to borrowing USDC, resulting in a net positive. However, it is important to note that these APYs can change so it is necessary to keep an eye on them. USDT’s high Max LTV percentage also allows us to borrow more against it than other assets.

There are other benefits which are outlined in the previously mentioned article on the loop strategy. You may choose different assets depending on your strategy.

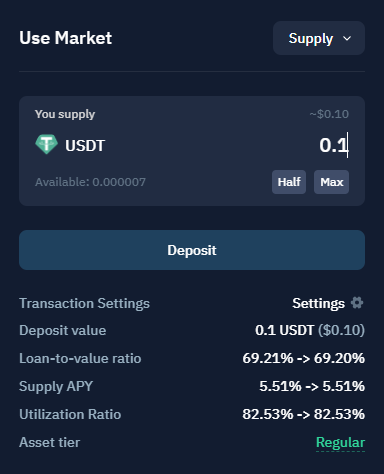

Step 3: Lend Asset A

To begin, click the ‘supply’ button to specify the amount of USDT to deposit.

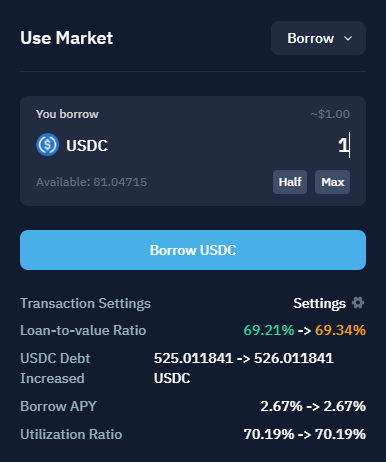

Step 4: Borrow Asset B

Then, click the ‘Borrow’ button for USDC, determining the desired borrowing amount.

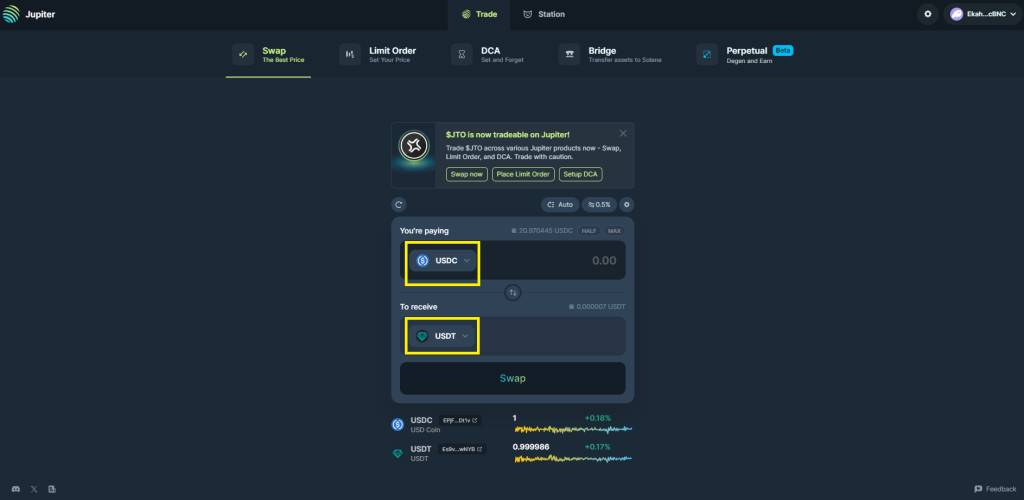

Step 5: Swap Asset B for Asset A

We then head to a decentralised exchange such as Jupiter where we exchange our borrowed USDC for more USDT. We are then able to feed that USDT back into the loop.

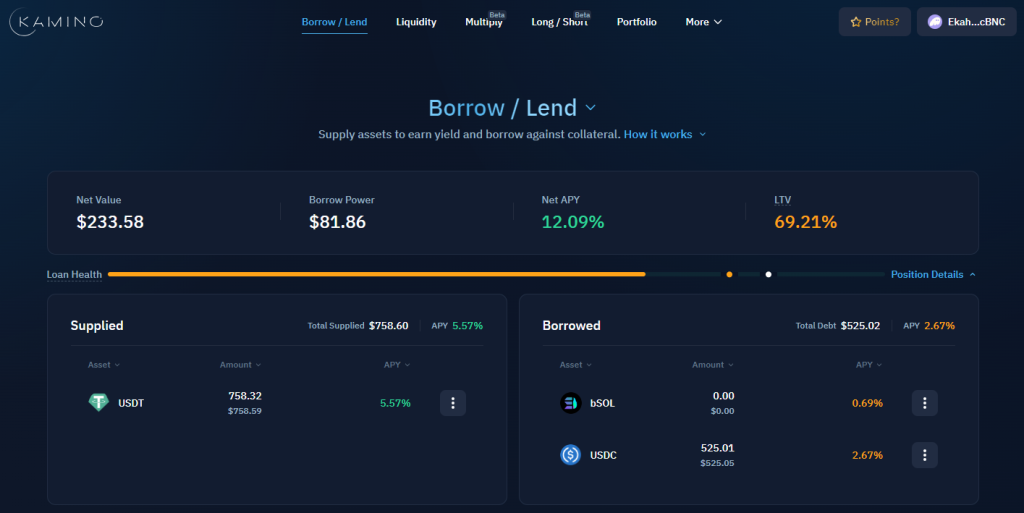

Step 6: Manage Position

Kamino’s dashboard offers a user-friendly interface for position management, focusing on key metrics:

- Net APY – Targeting a positive value is optimal.

- LTV – Higher LTV increases the risk of liquidation.

- Loan Health Bar – Proximity to the white dot indicates a higher risk of liquidation.

Liquidation risks stem from underlying asset volatility. For instance, lending $200 SOL and borrowing $150 USDC results in a 75% LTV. If SOL’s value drops to $175, the LTV increases to approximately 86%, leading to potential liquidation.

Using stablecoins mitigates price fluctuations, with the main risk being a depeg scenario.

Conclusion

Kamino provides a user-friendly interface for beginners and advanced services for seasoned DeFi users. Specifics about Kamino’s points system and its translation into an airdrop are yet to be disclosed.