Whirltools

About Whirltools

The Mission

Whirltools strive to be one of the largest revenue-share projects in the NFT ecosystem. With revenue being generated through a wide variety of services and a small collection supply, Whirltools is aiming to provide a significant amount of Solana rev-share to a small collection of holders. In addition to passive profits, NFT holders have access to a number of utilities and tools created by Whirltools for a discounted price or free depending on the tool.

Tools and Services

*All tools listed below are sources of revenue for Whirltools

- Whirlswap (multi-chain capable P2P NFT trading)

- Bulk Airdrop Service

- Bulk NFT Sending

- P2P NFT Lending (multi-chain)

- Raffle Hub (multi-chain)

- Metadata Updating

- Portfolio Tracker

- Whitelist Collab Discord Bot

- Whitelist Application Hub

- Discord Security Bots

- Misc. development services (DAPP development, staking contracts, rust contracts, web design, etc.)

Worklog

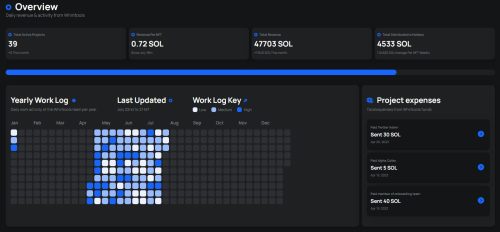

Whirltools is transparent about sharing their workload and development roadmap. They do this with an overview and a bulletin view; where the overview displays a snapshot of work completed as well as revenue statistics and the bulletin shows ongoing work and progress in more detail.

The overview displays limited details on historic tasks completed, but does provide some information nonetheless. The key aspects of the statistics displayed for holders or investors is the average revenue shared with holders, which can be viewed for the most recent week as well as an all-time average.

An image of the dashboard can be viewed below, but is accessible at dashboard.whirltools.io

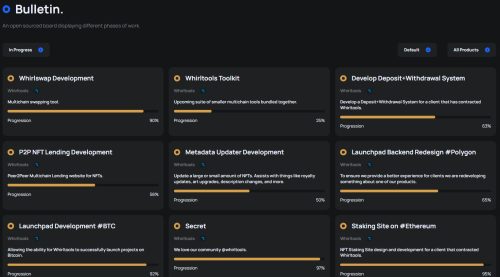

The bulletin has access to a more detailed summary of all work, past present, and future. Many of the specific details are left out of these updates, likely to keep anonymity for the clients they are working with.

An image of the bulletin can be viewed below, but is accessible at bulletin.whirltools.io

The Collection

The art and branding for the limited, 333-supply collection was designed to be a creative, yet business-focused PFP. The base character of each NFT boasts a suit and tie, providing a professional, “get down to business” branding image.

Holder Benefits

Revenue share

- 10% of revenue generated from development services

- 50% of revenue generated from platform fees

Referrals

- 10% of revenue generated from referring Whirltools services is provided to the referring holder

- This is also available to non-holders, but at a smaller 5% revenue share

Discounts

- Free access to all services

- No platform fees

- Various discounts for particular services (does not include development)

BigDaddyDegen

- Founder

- Twitter: @daddydegennft

Alfie

- Advisor

- Twitter: @carl03991880

Mubeen

- Business Development

- Twitter: @0xMubeen

Alejandro

- Team Management

- Twitter: @NFTs_Alejandro

3G

- Team Management and Graphic Design

- Twitter: @GG3_sol

Fate

- Creative Lead

- Twitter: @SolFatee

When Whirltools minted, rev-share utility was at an all-time high and many were confident it was the best utility to have. That cult-like following for rev-share has died off a bit, but many still feel that these are the only projects worth investing in. Regardless, there are several things that I think Whirltools is doing and have done exceptionally well with since their launch, but I also hold some reservations.

Supply

The collection is limited to a supply of 333, and I particularly like this aspect. Especially for something like rev-share, I find this enticing as often you need to be a whale in rev-share collections in order to get any appreciable amount of pay-out. With a small collection size, it feels much more tailored to legitimate and dedicated investors looking for rev-share rather than a quick flip. The positive impact of this is two-fold.

Frequently the number of unique holders increases (meaning that people only hold 1 NFT), and this can be very beneficial as it expands the reach of the collection to more holders, which can help foster a stronger network within the holder community.

With many people only holding one (or very few), they tend to take on the mentality that they won’t sell their NFT if the rev-share payout performs well. Once their NFT has “paid for itself”, they continue to hold onto it for life.

Point #2 above is quite important, as when you need to hold 50+ NFTs in a rev-share project to get reasonable returns, you are much more likely to sell them off after some time to ensure you lock in profit. This aspect of scaling out is diminished when a majority of holders only have 1-2 NFTs.

Workload and Transparency

I think the bulletin and dashboard are an excellent feature to provide some level of transparency and comfort to holders. My biggest issue with it is that it doesn’t provide any details on what is actually being built, whether it’s the mission, the client, anything. All of the actual useful details are hidden and kept anonymous.

Additionally, one opportunity thing that falls very short here is that there is no viewable portfolio of work completed. I think any development group that is building great products should be eager to display their work. They should be boasting that work so others know what to expect when working with them, but also to show the holders what is being completed so they can help spread the word and be proud of what they have invested in.

Publicity and Marketing

In short, I think the social presence for whirltools could be improved. It is a small collection, so expecting holders to make a lot of noise is unrealistic. The official whirltools pages don’t create much content or engagement opportunities, however when they do share something it is often very well thoughtout and impactful. Their content is very valuable, but they could use more quantity to assist in making some noise for their development services and spreading the word about what they offer.

The other major gripe is with the content shared by holders in regards to Whirltools. Most of the content that gets spread from holders is about the rev-share and contains screenshots of their recent payout. I see this as an massive missed opportunity for both the holders and the project. All holders get compensated based off of the work that the project completes, which suggests that they should be sharing some accomplishments that Whirltools has completed because more project and more work means more rev share. And the project would benefit from having holders help spread the work about what they can and have built to bring in more clients. I think the only benefit that could come from sharing the payouts is an attempt to pump the floor price, but even then it won’t make much difference as rev share projects tend to have a floor price locked to their payouts.

Closing Thoughts

From a business/project standpoint, I often wonder why many projects that offer services have an NFT attached to them. In the case of Whirltools, I think that the rev-share aspect is simply taking away funding that should be going to the team because NFT holders do not provide enough value to justify how much they cost. At the time of writing this, Whirltools has paid an average of 1.04 Sol/wk to each NFT. Do the math and that comes out to about 1,400 Solana in one month, which is nearly $35,000 USD. While that is a wildly impressive number, all I see is lost opportunity for the project. The holders are not providing enough value to the team to justify that cost. If even 1/3 of that amount was kept and used for marketing purposes, I think the project would see that pay off in multiples in terms of business inquiries. So in terms of business, I think is a project that would be better off without having an NFT.

From a holder’s standpoint, I think whirltools have done nothing but give holders everything they could ask for. Their rev share per NFT has been significant and consistent. My take on rev-share projects is often that if you don’t get in early you have missed your opportunity because the floor price will adjust to the expected rev-share payouts. Currently, if you bought a Whirltools at floor price (84 Sol), it would take approx. 1.5 years for it to recoup the initial investment. That is a very impressive return rate, but relies on the project to continue thriving, survive the bear market, and even get stronger in the bull market (and many projects do NOT live up to this). So that is the risk with investing after a rev-share project is established. If you can overcome those uncertainties, I think that Whirltools is one of the best passive rev-share projects currently available.