The Underground Society

About The Underground Society

Acquisition

It was announced on April 18th, 2023 that UGS Labs had been acquired by SharkyFi. The collection remains active and now operates under the SharkyFi umbrella.

Underground Society Labs

Underground Society Labs aims to create solutions that benefit the NFT ecosystem as a whole through the building of various products and services.

At present, these are:

- Core

- A Solana-based Automated Liquidity Provider (ALP) which will allow users to purchase NFTs significantly below listing price

- Cedar

- A Conditional NFT generator that overcomes common issues projects face with art generation such as clashes in layering.

- The Black Market

- An Auction House for users to access exclusive opportunities such as 1/1 art, whitelist spots and various other prizes.

The Underground Society Collection

The NFT itself is a PFP collection with a supply of 5000. Holders receive unique benefits tied to the UGS Labs’ creations.

The collection is divided into three factions (Mordax, Arco and Othon), which are further subdivided into five classes. Through various gamified systems, the factions compete for prizes and participate in dictating the progression of the project’s lore.

Core

The UGS Labs team have identified a long-standing problem with the Solana NFT marketplace – a lack of liquidity. Core aims to solve this problem as the centrepiece of UGS Labs and functions through their browser extension which can be found for here Google Chrome users. Users can then interact with their usual marketplaces and access Core’s services to acquire liquidity where necessary in a buy now, pay later type of system. In a way, you are essentially leverage trading NFTs.

The UI appears very intuitive. The browser extension will overlay the marketplace with the UGS logo. Certain exchanges partnered with UGS Labs will have this feature without the need for the browser extension.

Upon clicking the logo, a buy window will be opened as per the image below.

The user can then determine how much of the initial cost they wish to front themselves starting at a minimum of 33% and a maximum of 99%. The NFT is then frozen in your wallet and is controlled through one of the following Core functions:

- The NFT can be listed on a marketplace for sale

- The NFT can be instantly sold into a partner AMM

- The user can add liquidity to either pay down their debt or pay it off entirely.

This mechanism opens up:

- Purchasing power for more users who may lack the initial liquidity to enter the market

- Collectors can capitalise on buying opportunities which they cannot afford at the time and pay them off later

- Traders who do not have the capital to buy an NFT to flip may do so buy taking out the loan, purchasing the NFT, flipping for a profit and pocketing the difference.

- A user may be curious about a project and want temporary access to investigate a project further without the upfront financial commitment.

At time of writing, Core is in a beta phase only accessible to holders of the Underground Society PFP collection.

There are no interest rates involved with borrowing, but rather a one-off fee ranging from 0.5% to 5% depending on the amount being loaned.

Liquidated NFTs will end up being auctioned on the Black Market.

Liquidity Pools

With Core’s primary function being providing liquidity, that liquidity needs to come from somewhere. Holders and members of the public will be able to participate in powering Core to help scale the protocol and reward those who assist in doing so.

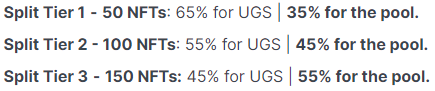

To create a pool, a holder must have at least 50 UGS NFTs. The more you hold, the larger the percentage the pool itself will earn.

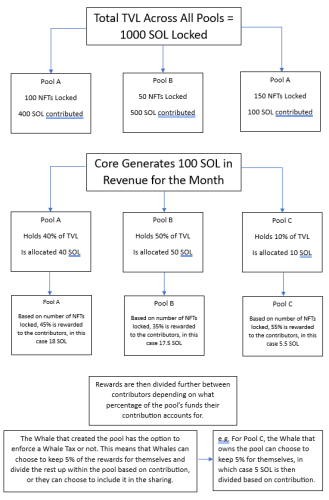

The mechanism of the pools themselves can be a bit to wrap our heads around. We will first discuss how people can participate in the pools and then by using a hypothetical scenario, explain how rewards are earned and distributed.

Lastly, earnings also increase the longer the pool remains active with a cap of around 75%.

Participating As A Whale (50+ NFT lock-up)

Whales have the chief benefit of being able to set up their own Liquidity Pools to participate in Core. In the set-up, they may dictate the following:

- Public vs Private

- As a private pool, only the creating Whale has access. As such they have complete ownership of the pool and are entitled to 100% of the pool’s earnings. However, since they are operating on their own, they may struggle to compete with other pools to get a significant share of the TVL

- As a public pool, Whales can open up for others (holders and non-holders) to contribute to their pools. In doing so, they increase their chances of having a higher portion of the TVL and therefore a larger portion of the earnings. That being said, they would then need to divide those earnings amongst the other contributors

- As you can see, it’s a balancing act for the Whale to work out how to best position themselves

- Whale Tax

- To the best of our understanding, Whale Tax only comes into consideration in Public Pools

- As the creating Whale, you also have the option to set the Whale Tax. This is a certain percentage (maximum 5%) that the Whale is guaranteed to keep for themselves from the pool rewards. In other words, A Whale that has 150 NFTs locked up can choose to have the maximum Whale Tax, in which case they will receive 5% of the 55% earnings and the remaining 50% is divided amongst the other contributors.

- So a Whale creating a Public Pool can set a lower Whale Tax to try and entice contributors to join their pool, or choose to ensure they get benefits for setting the pool up.

As a non-Whale Holder or non-Holder

Other users can only participate in Public Pools by contributing SOL. No NFT lock-ups are required. A few things that one might consider when choosing which Public Pool to contribute to include:

- What is the pool’s Whale Tax set to? The higher it is, the less there will be to be shared between other contributors

- How many NFTs are locked up in the pool? The higher tier lock-ups receive a larger percentage of earnings

- What percentage of the total TVL does the pool account for?

- What percentage of the pool can you potentially own through your contribution?

- Do you try and go heavy into one pool to have a larger percentage ownership of it? Or do you spread yourself across multiple pools for exposure?

How the Pools Work

In order to help explain this, I’ve created a hypothetical scenario to show how earnings and rewards are distributed using some easily divisible numbers. As you can see from the example, although Pool B accounts for a larger percentage of the TVL, it’s earnings are lower than Pool A due to having fewer NFTs locked up. Full credit to ARC from the team for walking me through this.

The Black Market

The Black Market will facilitate the following:

- Auctions on liquidated NFTs from Core

- Auctions on work from 1/1 Artists

- Raffles to win NFTs, 1/1s and/or whitelist spots

- Hosting of general raffles and auctions from the broader community

Auctions and Raffles hosted on The Black Market will fall into one of three tiers:

- Private

- Exclusively for holders of the Underground Society NFTs to give holders a higher probability of winning an NFT well below the floor.

- Public

- Available to all users, however non-holders will be required to use the native token $TALON to participate

- General

Cedar

Cedar is a conditional art generator that was created by the UGS Labs team to solve issues they themselves were experiencing with their collection. For example, prominent hair traits need to be completely hidden if there is a hat that is supposed to cover it. Cedar provides a solution to successfully layering traits.

The Underground Society NFT Collection

Community and Factions

The three factions – Arco, Mordax and Othon – will compete through various community events. Winners will receive awards such as 1/1 airdrops, $TALON and the opportunity to dictate the progression of the Lore. Losers may face punishments such as NFT mutations.

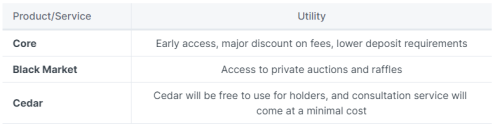

Utilities

Holders of the NFT collection will receive the following benefits on the platforms built by UGS Labs with more to be released at a later date.

$TALON

NFT holders will be able to stake their NFTs to earn $TALON at a rate of 10 per day, per NFT. With a 5000 supply, this is a maximum emission rate of 50 000 $TALON per day with a total supply of 100 million tokens.

$TALON will be utilised throughout the UGS Labs products such as:

- The Black Market – payment for bids or entry into auctions

- Purchasing tickets for raffles

- Accumulating certain amounts of $TALON will provide the holder discounted trading fees

- Trait swapping and upgrading of NFTs

Chironex Fleckeri

- Founder

- Twitter: @Ch1r0nex

Shaifer2pc

- COO

- Twitter: @instoreDon

JohnnyBoy

- CIO

Jake MC.

- Head of Business Development

- Twitter: @Jake_mccarthyy

Lite

- Marketing

- Twitter: @LitecoinYagami

Searcher the Don

- Community Manger

SolSnatcher

- Director of Strategic Partnerships

Mihtonmi

- IT – Rust Dev

- Twitter: @mihtonmi

Saita

- IT – Web Dev

- Twitter: @saita_NFT

MetalGear

- IT – Fullstack Dev

- Twitter: @davidlu_117

Monarch

- Writer

- Twitter: @MonarchHunter

Streetbeasts

- 3D Artist

- Twitter: @StreetBeastsART

Gecko

- Art Director

- Twitter: @wagmigecko

Core

The key consideration with any project such as this one is ultimately the cost of entry versus the benefits of being a holder, especially when tools don’t require you to be a holder to use. Where there is quantifiable utility and/or returns to be made, a ceiling is inevitably created.

Do I like the concept of what the UGS Labs team have created with Core? Absolutely I do. It opens up more avenues for traders and collectors to get involved in markets that they would otherwise be priced out of. Naturally with that comes a responsibility for them to fully understand what it is they are using to engage with the space. More liquidity is something NFTs have struggled with for a long time and this offers one solution to that problem.

Whether or not I can justify buying an NFT will come down to how often I would expect to use the platform and therefore take advantage of any discounted fees. For someone like myself who is a bit more conservative in my approach, I’m not certain yet that I would get value compared to someone who might be looking to use Core to facilitate regular flipping/trading of NFTs.

The Liquidity Pools

The Liquidity Pools also pose a question. At time of writing, 50 UGS NFTs will require around 350 SOL in outlay. That is a lot of capital to front for the chief benefit of being able to impose a Whale Tax to earn up to 5% more through the liquidity pools. In doing so, I am also exposing myself to price action of both the NFT and SOL itself for the duration of the lock up which for me poses significantly more risk than reward. One could argue that having such large quantities (minimum 1% of the supply) locked up can be interpreted as bullish, but ultimately there will be a plateau reached between balancing the cost of the NFTs and expected additional returns from the LP.

I would much rather just contribute to somebody else’s public pool. Yes the earnings may be less since you’re competing not only within your own pool but against other pools, but there is significantly less risk involved as you are only exposed to SOL’s price action. I am also of the opinion that it would be far simpler to contribute to a pool if it was just the one big pool to contribute to rather than having to choose from several as you now have to factor in the size of the pool (relative to both the TVL and yourself), the number of NFTs locked up and Whale tax settings and then monitor it as the optimal pool may change over time.

The prospect of simply providing liquidity unilaterally in the form of SOL is VERY appealing. Simply providing SOL and earning interest rates on people borrowing could be a worthwhile way to earn without the risk of impermanent loss. Would I be buying 50 NFTs to try and increase those earnings? That’s a hard sell at the moment.