The Keepers

About The Keepers

What do The Keepers bring to this space?

Boasting an experienced team with a long term vision, The Keepers are a technology focused project that are developing several tools aimed at improving the experience for the average NFT user. On top of that they have put an incredible amount of work into creating Artwork that holders can proudly rep as their PFP, a reward system for their holders and aim to foster a strong brand & community.

Several tools are in development with only 3 that are public knowledge at the time of writing:

- PFP Staking Hub

- The Keepers Shield

- Re-Forging

Revenue Streams:

PFP Staking Licenses – Charged as a one time fee for every license issued.

The Keepers Shield – Charged as a fee of the Premium that the policy buyer has to pay.

The Keepers Hub – A fee payable by partner collections for using The Keepers Hub.

Royalties – A percentage of secondary sales.

Note: Exact percentages and fees are yet to be announced.

How will mint funds be distributed?

All mint funds will be held in multi-sig team treasury in SOL and USDC. The breakdown is as follows:

- 90% Project and Development Funding:

- 65% development of products

- 30% Marketing and Sales

- 5% Staff

- 10% Community Treasury:

- Visible for members

- Funds holder competition rewards

- Supports the Solana ecosystem by staking sol and acquiring accomplished and promising NFTs, 1/1 art and tokens

- Re-Funded by a share of the royalties and revenue.

Note: These are first estimates and subject to change.

Holder Benefits:

- A Revenue Sharing reward system for loyal holders.

- Deflationary Collection by reducing supply through a burn mechanism.

- Discounts for using the NFT Insurance platform.

- The ability to earn The Keepers native token – $KEPR.

The Keepers Hub:

A central hub where every Solana NFT collection can easily self-onboard onto the platform. They will empower Solana NFT projects of all sizes to provide their communities with their own unique PFP staking experience. This collaborative ecosystem fosters growth, cross-promotion, and a sense of community within the Solana NFT space.

PFP Staking:

Introducing a revolutionary tool that allows users to maximize the value and utility of their NFTs through staking, unlocking a range of benefits and creating new opportunities for NFT holders. Users now have the ability to ‘Stake’ their NFT, simply by using it as their PFP on popular social media platforms.

By staking their PFP, holders gain increased visibility within the community and over social media becoming recognized as active participants within the community. The project also receives increased exposure and advertising through the incentivization of PFP staking fostering a vibrant and active community.

By utilizing advanced artificial intelligence algorithms, The Keepers scan and validate whether the owner of the PFP is the rightful owner of the corresponding NFT in their wallet. This innovative technology adds an extra layer of security, ensuring authenticity and severely reducing the effects of fraudulent activity.

Through their licensing business model, they enable other projects to leverage their infrastructure by being able to create their own customized PFP staking platforms to suit their own communities.

The Keepers Shield:

Introducing a transformative solution for NFT investors, offering them a reliable and customizable insurance protocol to protect their assets from potential floor price collapse.

The platform facilitates peer-to-peer (P2P) interactions between insurers and policy buyers, promoting transparency and eliminating the need for intermediaries.

All policies are customizable and transferable with full freedom and control of the NFT allowing it to be traded, sold or utilized without restrictions.

The Keepers Shield utilizes smart contracts on the blockchain to facilitate policy creation, premium payments and claims processing which ensures the security of the insurance policies. Determining the floor price of insured NFTs is done by oracle integration that fetches real-time market data ensuring accurate valuation and efficient claims processing.

If a policy buyer wishes to initiate a claim during the policies validity period, it is all automated ensuring efficient and transparent settlements.

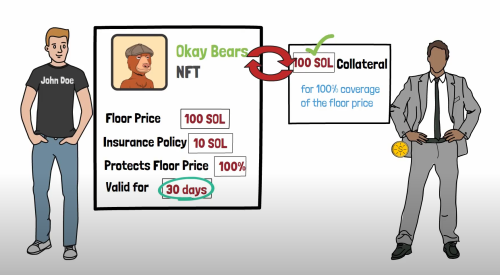

Once a policy has been accepted the premium is paid in full to the insurer and the insured amount in Solana is transferred into an ‘escrow’ wallet for the term of the policy. If a claim is initiated the NFT is to be sent to the insurer and the collateral in escrow is sent to the policy holder, completing the agreement.

Re-Forging:

The Keepers will be introducing the Re-Forging tool, empowering minters to obtain their desired traits within the available options. While little information is available, this seems to be a trait swap / customization style tool.

The Keepers native token $KEPR:

No information has currently been released for the Tokenomics of the $KEPR token.

MileStone – Project Lead

- Web 2/e-commerce background

- In crypto since 2017

- Angel investor in crypto startups since 2021

- Solana investor since day 1

- Visited 10+ IRL Solana events

modsiw – Tech Lead

- Internet of Things with 25+ years of experience in the field

- Crypto OG since 2011

- Founder of Cz Labs

Jazzylay – Branding Lead

- Autodidactic jack of all trades

- Background in illustration, story writing, game development and marketing

- Inspired by comics, video games, cartoon network

- In Solana since 2021

Hyperstrike – Operations Lead

- Solana gigabrain since 2021

- Cardboard Citizens owner and postmaster

Chromy – Collab Lead

- Well respected in many major communities

- Alpha caller for many major DAOs

- Well connected in the space

KB – Community Lead

- In Solana since 2021

- Been active in many major communities

- Experience in leadership and community management

In addition to their Core Team they also have:

- 4 x Software Engineers

- 1 x UI/UX Designer

- 1 x Artist

- 1 x Chief Marketing Officer

- Staff

- Advisors

The Keepers have ushered in a whole new concept to the Web3 space, NFT Insurance! The way i see it, this is very similar to the rise of borrowing and lending but with a twist. Instead of providing P2P loans, they are providing P2P insurance where the ‘lender’ receives a premium and the ‘borrower’ receives peace of mind that their desired NFT will be protected from potential floor price collapse.

PFP Staking:

It has been announced the team are working on several tools but the specifics of those tools still remain a mystery for the most part.

We have seen the PFP staking go live which i think is a great concept but the question is, will a quality project pay a fee to a third party so that their community members can receive rewards for rocking their collection?

In my opinion, i don’t see this gaining traction with blue chip projects as holders will naturally rock their pfp but i do think this could be a good tool for low or medium cap collections to incentivize their holders, which in return will bring more awareness and exposure to the brand. I don’t see this tool being a huge revenue generator, nonetheless its another source of income for the team. I’m putting The Keepers Hub tool in the same category as this.

The Keepers Shield:

This seems like it will become the Flagship Product for The Keepers.

An NFT Insurance Protocol is a concept that has not been done before in the space. I personally think it’s a great idea and another way for participants to earn some interest on their SOL. Although this doesn’t come without its risks, i think this will become a popular tool especially amongst the current borrowing and lending crowd as it is much the same target audience. We already know that a large percentage of users on these lending platforms ‘hedge’ their NFT to avoid potential floor price collapse so a tool like The Keepers Shield will certainly appeal to that crowd.

Let me explain how it works:

I have an Okay Bears NFT with a current floor price of 100 SOL. I want to protect 100% of my NFT so i purchase a 30 day policy for 10 SOL that allows me to exchange my Okay Bears NFT for 100 SOL at any point during those 30 days.

This provides me with peace of mind that my money is protected whilst providing the insurer with a way to earn additional Solana – as long as the floor price stays above 100 sol.

Policies can be created by an Insurer AND someone looking to have their NFT insured. These policies are fully customizable and a claim can only be initiated if the floor price of the NFT falls below what is specified in the policy.

In terms of revenue, i would assume this will bring in a large percentage of sales for The Keepers as it becomes one of their more popular tools.

Re-Forging:

Not much information available on this at the moment apart from it allowing minters to potentially ‘re-roll’ specific traits. During our interview with Milestone, he did state that it will most likely cost Solana to ‘re-roll’ traits.

The $KEPR Token:

No information available on Tokenomics at this point in time. Until i know more i cannot give my opinion on this but one thing i will say is this needs to be done right. By adding a utility token to a project like this it can create a lot of complications if not done properly. There needs to be consistent utility and buying pressure on the token otherwise it will create an excess of supply and with no use-case the token price will drop and eventually become worthless. I personally would like to see The Keepers scrap the utility token and move toward a points system.

Team:

The Core Team are fully doxxed although information on them is not readily available.

Milestone presented The Keepers on stage at the Solana Hacker House in Tel Aviv so the team do have a reputation to uphold. It’s great seeing project founders getting out and promoting their project and fostering relationships within the space.

My Thoughts….

With very little information currently available on the project and the tools they are building, it makes it hard to draw a definitive conclusion.

I’m going to speak on the Insurance Protocol as that is where I believe The Keepers main source of revenue will come from.

I think this concept is going to become very popular and with The Keepers being first to market with this model, it could be a very lucrative tool for them. If this model takes off you can bet your bottom dollar that there will be competition popping up all over the place.

By being first they need to make sure they do it properly! Creating a quality, aesthetically pleasing platform with a seamless experience that users enjoy and become familiar with is important. Failure to do so could see new found competition take serious market share.

The other question that arises is: How easy is it for one of the large lending protocols like SharkyFi to incorporate this into their business model?

If this gains popularity, is SharkyFi going to be able to quickly add this Insurance function into their platform? If the answer is yes, this could be a big problem for The Keepers.

During our interview, Milestone did say he was in discussions with some of the large lending platforms to form a potential partnership that would see them working together instead of fighting for market share. I think this is a great idea, creating a win win for both companies. If he can get this partnership over the line thats a huge win not only for the projects but for the eco-system as well.

The good thing about the Insurance Protocol is that there is room to grow. The team have said they will eventually expand coverage options and integrate with various blockchain ecosystems. This means we could see NFT Insurance rise to fame on Ethereum which will be very interesting considering the overall value of NFTs are a lot higher than that of Solana.

Security is going to be another huge aspect of this protocol. From what I understand, there is no cap on the duration of the loan so if somebody was to accidentally accept a policy without properly checking the duration, there is no ‘cooling off’ period where either party can cancel. So making sure to double check all details of the policy is incredibly important. This could be fixed by putting a limit on the duration of a policy to avoid people from taking advantage of such a situation.

Adding on to this, if your insured NFT is hacked or your wallet is drained there is no way for you to claim. This is because the policy is attached to the NFT itself, which would give the hacker the ability to claim your insurance policy. The benefit of this though, is it allows you to send the NFT to a different wallet, list it on secondary and borrow against it without having to ‘lock’ it up in escrow, giving you full control. If I was going to insure an NFT I would make sure I have created a fresh wallet that is linked to a hardware device like a Ledger and store my insured NFTs in that wallet. That way I have peace of mind they are secure.

The other question that always seems to cross my mind with projects like this is ‘Why do we need an NFT?’

The way I see it, there are only 2 reasons that most projects create an NFT:

1. They need to raise capital

2. They want more brand exposure

The problem I find with option 1 is quite often Founders do not realize the amount of on going work that is required to run an NFT collection, especially when you attach an SPL token to it. Sure you might raise a bunch of money but once that money is depleted you still need to provide on going value to your NFT & SPL token otherwise the floor price collapses as people start to dump. If The Keepers cannot create sustainable revenue with their mint funds that will create a huge problem in the future.

Milestone did state that the main reason for a collection was to raise money but with an experienced core team, good tokenomics, strong industry partnerships and a solid community I can definitely see The Keepers becoming a house-hold name.

Lastly, they have implemented a revenue sharing model with holders but little information is available on the finer details.

My only concern at the moment is can the project raise enough money to build their tech, pay all their team, share a percentage of revenue and provide on going value to holders all while growing their business and creating sustainable revenue?

In conclusion, I am excited to see what The Keepers can accomplish. As this is more of a utility project I wouldn’t expect floor price to appreciate dramatically but if it can pull off something similar to SharkyFi I could be wrong. If they continue to create high quality and in-demand tools then this could definitely be a good buy but currently, there is still a lot of information to be released to the general public so for now make sure you stay up to date with this Review and I will update it with the necessary information as it becomes available.

Update: As of 23/08/2023 The Keepers have secured a grant from the Solana Foundation which is amazing news! Not only will that increase their runway but it also shows their conviction in the project.