SolCasino.io

About SolCasino.io

Solcasino.io is one of the top Curacao-licensed “casinos” currently on the Solana blockchain which also offers mutlichain features. With the recent release of their NFT collection, individuals now have the opportunity to obtain fractional ownership of Solcasino.io and yield rewards.

NFT Collection

This collection features 5,000 NFTs centred around bears as their primary character. It’s a unique collection design filled with a range of distinctive traits that set it apart. Each piece from the collection was minted at 12 sol, with the minting event taking place on the 3rd of April 2023.

In an intriguing move, the Solcasino.io team opted to refund the minting cost for every Solcasino NFT. To claim this 12 sol, holders were required to deposit their Solcasino NFT for a randomly determined period of time. There were six possible deposit durations: 15, 30, 45, 60, 75, and 90 days, with the final unlocking scheduled for the 3rd of August 2023.

Casino

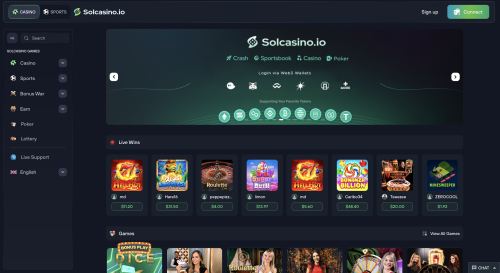

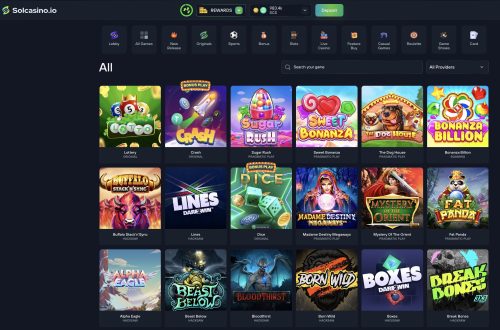

Launched in December 2021, Solcasino.io emerged as the first licensed multi-chain casino on the Solana Blockchain. It allows users to engage in various games of chance and skill using their web3 wallets. As the user base of Solcasino expanded, the platform broadened its support to include multiple chains such as BTC, ETH, BNB, MATIC, APTOS, CANTO, and FTM. This enhancement means users can now seamlessly connect their crypto wallets, including Phantom, Solflare, Metamask, and WalletConnect, to play on Solcasino.io.

Solcasino.io has earned a solid reputation, consistently securing a spot among the top 10 dApps on Solana based on gambling volume. The casino is renowned for its polished UI/UX, offering players an expansive array of games. The selection includes:

Solcasino.io has earned a solid reputation, consistently securing a spot among the top 10 dApps on Solana based on gambling volume. The casino is renowned for its polished UI/UX, offering players an expansive array of games. The selection includes:

– Slots

– Casual Games- Table Games

– Game Show

– Sportsbetting

– Bonus Wars

Benefits & Opportunities on Solcasino

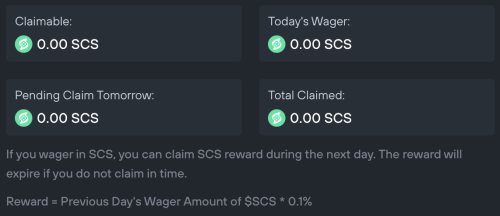

Bet2Earn

When you place wagers using $SCS, you’re eligible to claim 0.1% of the previous day’s wager in $SCS. For instance, if you wagered 1,000 $SCS tokens yesterday, you can claim 1 $SCS today.

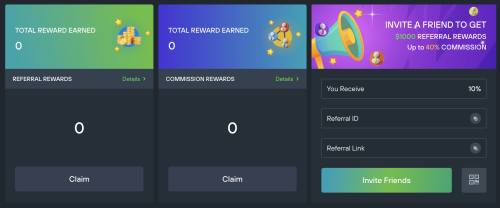

Affiliate Rewards System

An affiliate reward system in a casino is a program where individuals or groups earn commissions for referring new players to the casino. Through this system, affiliates can benefit from the actions of the players they introduce. Affiliates have the potential to earn up to a 40% commission.

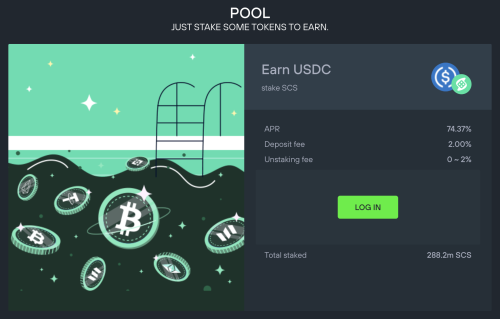

Pool Staking

Solcasino offers a native token staking pool for its $SCS token, allowing users to earn USDC by staking their $SCS. The potential USDC earnings increase with the amount of $SCS staked. There is a 2% deposit fee, and an unstaking fee that can vary between 0% and 2%.

The APR (Annual percentage rate) of the pool fluctuates depending of 3 factors.

1. Amount of USDC in the pool

2. Amount of $SCS staked (More $SCS = Less APR/ Less $SCS = Higher APR)

3. Price of token (Higher price = Less APR / Lower price = Higher APR)

NFT Lottery

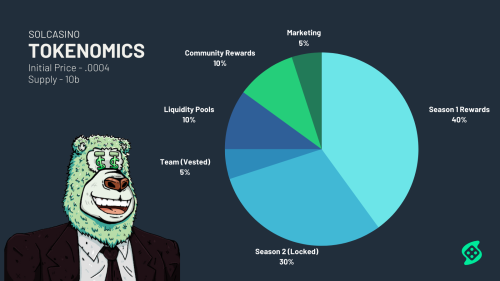

$SCS Tokenomics

Native token $SCS launched on May 8th

Price: .0004

Supply: 10,000,000,000

40% – Staking Pool for NFT Holders

30% – Locked for Season 2 (Locked for 12 months)

10% – Liquidity Pools

10% – Community Rewards

5% – Team (Locked for 6 months then vested over a 12 month period)

5% – Marketing

Token Address: SCSuPPNUSypLBsV4darsrYNg4ANPgaGhKhsA3GmMyjz

To support token price and pool staking, Solcasino allocates 40% of their profits generated from the casino. The exact profit numbers aren’t publicly announced, but Solana volume data on DappRadar

![]()

NFT Staking

Solcasino NFTs can be staked on a 3-day locking contract to yield $SCS. The amount of $SCS earned depends on the rank of the NFT.

Daily rewards based on rank:

1-7: 1973 $SCS (+20%)

8-100: 1907 $SCS (+16%)

101-500 1825 $SCS (+11%)

501-1000: 1791 $SCS (+9%)

1001-2000: 1759 $SCS (+7%)

2001-3000: 1726 $SCS (+5%)

3001-5000: 1644 $SCS

This puts their maximum $SCS emissions per day at 8,589,662 $SCS

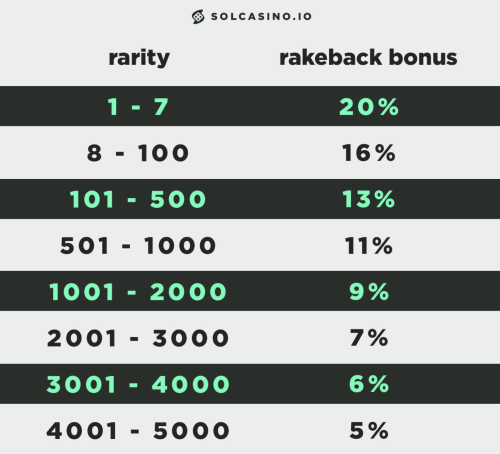

Rakeback

Rakeback is a form of cashback for gamblers, allowing them to earn back a portion of money they gambled during their gameplay.

Owning a Solcasino NFT rewards you with a rakeback bonus when gambling on their casino.

The % of rakeback bonus depends on the rarity of the Solcasino. The higher the rank, the more rakeback bonus you receive.

Fiyopi

- Founder & Marketing Lead

- @0xFiyopi

TG3

- CEO

- @0xTG3

Vak

- Co-Founder & Partnership Lead

- @Vakkk777

Kano

- Co-Founder & Product Tech Lead

- @kkanoee

HelloStarlight

- Co-Founder & Artist and Design Lead

- @HelloStarlight0

Thoughts on Tokenomics

People often wonder why Solcasino never pursued the path of direct USD claims instead of choosing a tokenised revenue. I believe the rationale behind Solcasino’s choice of a tokenised revenue sharing model seems to be a mitigation strategy against market volatility. Direct USD payouts could fluctuate considerably from one week or month to the next, making the NFT collection’s value vulnerable to the timing and magnitude of these payments. On the other hand, a tokenised system provides holders with the flexibility to claim staking rewards and freely trade the tokens as they see fit. Furthermore, this strategy simplifies the integration of their token within the casino and enables token pool staking.

Solcasino’s approach to token pool staking to farm USD appears to be more beneficial in the short term than in the long run. Initially, by locking up a majority of the circulating supply into staking, it can reduce the immediate sell pressure. However, as more $SCS tokens are emitted, tokens will continue to be funnelled into the staking pool, leading to a reduction in the pool’s Annual Percentage Rate (APR). Over an extended period, as the APR drops, the staking pool becomes less attractive, resulting in fewer tokens being staked. This can lead to an increased circulating supply, which may create a higher selling pressure, ultimately driving down the $SCS token price. In essence, the long-term sustainability of the token’s price may be at risk under this model.

Sustainability

Solcasino.io operates on a successful and sustainable business model. However, with the introduction of their new NFT collection which offers holders a portion of the profits and rakeback bonuses, raises questions about the casino’s performance and its ability to maintain sustainable and consistency of shared profits. Since their isn’t any publicly released information on generated revenue or wagered volume, I’m going to create a simplified hypothetical scenario where we can estimate the rough dollar worth of $SCS emitted per day and the rough volume required by the casino to sustain that token price.

*Figures calculated at the time of writing

Token price: $0.003 (average)

Total $SCS emissions per day: 8,589,662

Percentage of Solcasino staked: 95%

Therefore dollar worth of $SCS emitted per day can be calculated by

= $SCS emitted per day * % of Solcasino staked * token price

= 8,589,662 * 0.95 * $0.003

≈ $24,500/day ( just shy of $9 million/year )

This tells us that to maintain an $SCS price of $0.003, the Solcasino team would need to allocate $24,500 USD daily, totalling nearly $9,000,000 USD annually. To determine the wagered volume necessary for the casino to generate $24,500, we’d need to consider their profit margin per bet. While this exact figure isn’t publicly disclosed, let’s assume a 5% profit margin for each transaction. This implies that the casino gains a profit of $0.05 for every dollar wagered.

Revenue: $24500

Profit Margin: 5%

To find the required wagered volume to generate $24,500, we divide $24,500 by the profit margin :

24,500/0.05 = $490,000

Therefore, to sustain the $SCS price, Solcasino.io would require a daily wagered volume of $490,000. However, this simplified scenario doesn’t account for other casino offerings like rakeback and referral systems, which could reduce their profit margin. Below are examples showcasing different profit margins and the corresponding wagered volumes needed to achieve a daily revenue of $24,500

8% Profit Margin

24,500/0.08 = $306,250

2% Profit Margin

24,500/0.02 = $1,225,000

Based on the above calculations, I believe the current price of $0.003 for $SCS seems unsustainable given the casino’s revenue dynamics. Achieving daily revenues exceeding $20k requires vast wagered volumes, especially when considering additional utilities like rakeback and referral systems, which decrease the casino’s profit margins. Moreover, only 40% of the casino’s profits are channeled towards supporting the token, further amplifying the need for increased wagered volumes. Data from DappRadar indicates that the casino’s volumes fall short of these requirements, leading me to suspect that the token may be overvalued and Solcasino will face challenges in maintaining its current price in the long run.

Why a NFT collection?

Solcasino.io, a successful web3 casino, has been operating effectively for several years. This raises the question, why the need for an NFT collection. Particularly since they didn’t raise any funds from minting. However, they stated the primary motivation behind Solcasino.io’s NFT launch is community engagement and marketing promotion. Since the NFT’s introduction, there has been a notable twofold surge in unique depositors on Solana. This strategy not only increased their visibility but also fortified a dedicated community and broadened their user base.

While there are advantages to launching an NFT collection, there are significant drawbacks to consider. Leveraging an NFT collection as a marketing tool can be effective, but when you factor in the cost of revenue-sharing payouts to NFT holders, it often surpasses the expenses of a standard marketing campaign. With rev-share exceeding $20k/day, Solcasino would actually save money by hiring a full-time staff of marketing professionals. Additionally, majority of the people interested in passive income projects are passive holders. Meaning they’re more inclined to simply collect their earnings rather than actively promote or “pump” their investments, further diminishing the marketing benefits of having an NFT collection.

Would I invest?

From a holder’s perspective, Solcasino seems to have consistently met and perhaps even exceeded expectations. Their team have upheld their promises and remain to provide indirect rev-share to holders. My personal take on rev-share projects is that it’s crucial to get buy-in early. As the project progresses, the floor price typically aligns with anticipated revenue payouts, establishing a direct correlation and potentially limiting the ROI for later entrants.

The success of revenue share model heavily relies on the project to continue thriving, remain profitable and adjust to market conditions (many projects do NOT live up to this). This underlines the inherent risks associated with investing in an rev-share based project. However, for those who can navigate these uncertainties, I believe Solcasino stands out as one of the premier passive revenue-sharing projects currently around.