Sharkyfi

About Sharkyfi

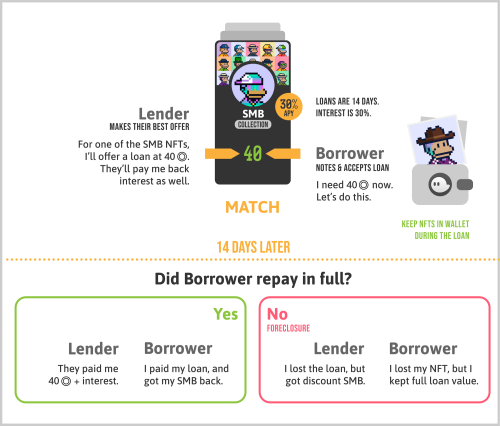

Sharx by Sharky.fi is the first escrow-less NFT lending protocol. In a nut shell, lend $SOL to earn $SOL, borrow Solana instantly against your Solana NFTS. Sharky is a platform where anyone can make loan offers for NFTS in a collection and holders choose the NFT to borrow instantly. You make money as a lender and you get cash on-demand as a borrower.

Short term loans usually have high interest, so Lenders can stand to make a lot of money in a short amount of time. Borrowers may have immediate need for cash (upcoming hyped mint) but no liquid cash. Sharky connects the lender to the borrower and they both get a good deal. Even in the case where the borrower fails to pay the loan back, the lender is still protected because the NFT is worth more than what they paid to offer the loan.

———————

Sharky is an already existing platform aiming to bridge the concepts of DeFi into the NFT world with peer-to-peer NFT-backed Loans with an orderbook system.

Lenders

Lenders will place **bids** on various NFT collections for how much they are prepared to loan against a certain NFT. For example, I can place a bid that I am willing to loan 300 SOL to someone who will put a DeGod up as collateral. As such, this is creating an orderbook of bids from prospective lenders to see who is prepared to offer the most amount of funds.

Lenders would have to consider things like:

– How much are you prepared to pay for the NFT in the event the borrower defaults?

– What is your outlook on that NFT? For example if you’re particularly bullish on something, you might be willing to offer a loan greater than the floor price in order to make your loan look more appealing.

Borrowers

Borrowers browse the bids available from prospective lenders and can accept a bid. **Borrowers cannot place orders from their side of the orderbook** so it is one-sided. The platforms idea is that the loans should always be less than the floor price of the NFT.

During the loan, the borrower **maintains ownership of the NFT** so that they can keep access to whatever Discords the need, but the NFT is wallet-locked so it cannot be transferred.

Either the borrower repays the loan or the NFT is transferred to the lender.

Borrowers would have to consider things like:

– If I were to default, what would be an acceptable amount of SOL I’d be willing to cop for it?

The Sharx NFT

Not a whole lot has been released about how the NFT comes into play other than a share of the revenue and royalties the platform brings in. At present, the platform charges **no fees** for the loan services but I presume this will be brought in eventually.

Holding Sharx will also earn $FISHY which can be used for:

– Raffles –> Sharky themselves will offer loans for NFTs and if the borrower defaults, the NFT will be raffled off amongst holders

– Have discounted platform fees

– Upgrade NFT for better perks

Miscellaneous

A large number of collections can already be used on the platform like DeGods, t00bs, Rascals, BSLs etc.

Current total loan volume has been 173K SOL

Loan APY will never go below 40%

The mint will occur alongside a live orderbook for the Sharx NFT so you could take a loan out against your Sharx immediately. Any loans repaid after 7 days will get 0.5SOL back.

In terms of how one might game this, it could be that if you’re bullish on it, you mint, take out loans to mint more then if the floor shoots up you were able to accumulate a big bag by loaning against your NFTs and the value of the loan is below the floor price. Whether or not the 0.5SOL rebate is worthwhile will depend on the APY% and the loan amount but if say you take out a 1 SOL loan, you’ll get a bonus almost half of that on top. Will have to see the numbers when they come out.

The utility for holders is to have access to all that Sharky has to offer. Sharky Holders can lend cash, opting to choose essentially how much they would pay to get a certain NFT at a discount. Sharky holders may also choose to be a Borrower for quick liquidity. Sharky has a points levelling system where contribution is rewards in points which are tradeable for $FISHY. $FISHY can be used to get access to pro-trading tools and analytics, participate in raffles for defaulted nfts and upgrade or level up your sharx. If your Sharky has paid full royalties and is ranked level 2 and up you qualify for gamified dual revenue share. Platform fees (&%/25) and royalties (50/50) will be funneled into the revenue pool to be shared with holders.

Sharky have an enormously balanced team which can be found here . The key Co-Founders are below.

Anton (Restuta) Engineering Lead, Solana, Risk Models, UX — Co-founder

LinkedIn | GitHub | Twitter Co-founded 2 successful startups before (Apination and Toast). Over 16 years of experience in building products and teams. Worked as Principal Engineer and Head of Engineering in various early stage startups (BuildingConnected, DivvyHomes, JuniLearning). Built and managed teams 1-30 engineers. He has extensive experience in real-estate, engineering productivity and education. Loves building products and teams. He turned down CTO roles in trad-tech to pursue building infra for NFTs and the metaverse. He likes to brag about investing in Ethereum early (and subsequently selling too early). Anton was immersed in crypto through multiple bull and bear markets, and is excited to bring new product standards to Web3.

![]()

Rea Strategy, Product, Design, Community — Co-founder

LinkedIn | Twitter | Instagram CalTech grad, serial founder, engineer, designer, founder of Slack Community. Gives engaging talks at conferences on engineering best practices, and live coding. Mentoring femme engineers and founders since 2016. Co-founded a startup with Anton (Toast) which is the top ranking Engineering app on Slack. Still operational and profitable venture. You can read about it more from Slack itself here and about Rea here. Rea made her way into crypto as an advisor in multiple early stage crypto teams, and led strategy on market and ecosystem opportunity. She’s well connected to thought leaders in Solana and Ethereum, and creates content for NFT + DeFi degens, Women in Web3, and Solana developer DAOs.

Sharky is an extremely proffessional project that has been ready to go since before mint. I was lucky to get a couple early days but at the time personally I was not interested in lending. In reviewing this project, this team is set up to become huge powerhouse is this space. I dont know the plans from the team but if they could integrate cross chain lending and borrowing this could be absolutely massive. I have added below some stats from the prior week that I believe speak volumes of the upward trajectory this project is in. They have sustainable income outside of royalties, strong business model and demand for their product. I think its safe to say we have only seen a scratch on the surface of what this team can continue to create!

————————

Pros:

– Existing platform already up and running

– Non-escrow borrowing so you get to keep holding your NFT for the duration of the loan

– Both borrowers and lenders earn $FISHY

Cons:

– Platform fees haven’t been revealed yet so hard to now how much revenue could be generated to be shared.

– Not many details yet on the NFT collection itself (mint date, price, collection size etc.)

I was never a huge player on DeFi personally but this is definitely interesting. From a lender’s perspective it seems to be a pretty good deal because the best offers currently sit quite a fair bit below the floor price each project so if you decide to put up your SOL, you’re either gonna earn a very decent APY as it stands (subject to fluctuations) or you’re gonna cop an NFT for free.

I personally don’t know if I’d be using the platform enough to really benefit from the reduced transaction fees but for someone who wants to really play on this, it would be worthwhile, especially with the added revshare bonus.

From what I can tell, the main risk for the Lender is that either the price of SOL tanks or the floor price of the NFT tanks. If the floor price drops below the value of the NFT, the borrower could just keep the SOL loan and buy another and lose their NFT. I suppose that’s why the current bids sit a fair bit lower than the floor price to provide that room.