Lender Labs

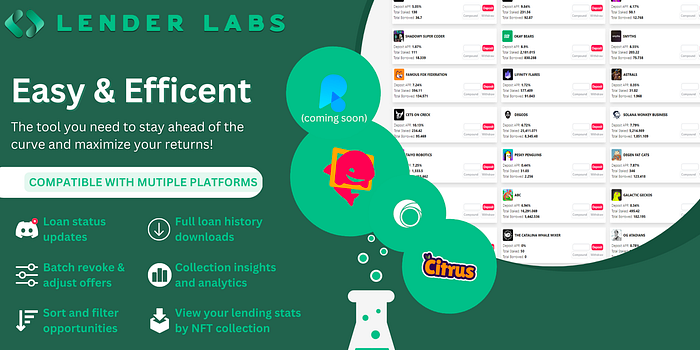

About Lender Labs

NFT Lending has recently seen a large upswing in activity as lenders seek opportunities to increase their holdings whilst borrowers seek short term liquidity for various plays. With an increase in both lending volume and different platforms competing for market share, tools and analytics that make our activities more efficient and effective will be valuable.

Enter: Lender Labs

Lender Labs provides a one-stop shop for all your lending needs from aggregating loans across the biggest platforms as well as a suite of tools to make your user experience seamless. At present, nearly 20% of all active SharkyFi loans are from offers created via Lender Labs; and that’s with limits on who can access the platform!

Features

Platform Aggregation

From one location, a user can view offers on collections across all three leading lending platforms. Each UI is tailored to reflect the lending platform’s UI along with additional features such as:

- Filtration/Sorting of collections

- Ability to ‘Favourite’ certain collections

- Current loan statistics and LTF percentages

- Revoke all function

- Live feed of loans being taken which can be filtered down to favourite collections only

- Dashboard of all your active offers and loans

- Ability to set more than three offers at a time

Analytics

Lender Labs affords the user various analytical tools including:

- History of your own lending

- Can be viewed by individual loans or across collections

- Full CSV reports can be exported

- History of somebody else’s lending

- Get data on somebody else’s borrowing habits

- Broader market statistics

- Across all marketplaces or by individual marketplace

- Collection insights

Future Features

Lender Labs’ plans for future features primarily centre around people being able to automate the process through functions such as:

- Auto-adjustment of loans as floor price of a collection moves

- Auto foreclosure of loans

Integration with other platforms such as rain.fi and Yawww are also coming.

The Collection

The collection features 5555 NFTs with Turtles as their base character with a mint price of 3 SOL each. 50% have already been sold in presale phases at 2 SOL with the public phase being a raffle style mint. Public Mint date has not been confirmed yet but the team are aiming for mid-June.

Platform Access

At present, access to the platform for borrowers is free for everyone to use.

Access on the lending side will be gated to holders of the NFT with holders of multiple NFTs receiving additional benefits as per the infographic above.

DaveTheFight

- Founder of Lender Labs

- Twitter: @DBerget

Stoizy

- Co-Founder of Lender Labs

- Founder of Revenue Rebels

- Co-Founder of Orbital

- Twitter: @StoizySolana

The Lender Labs Platform

Let me start by saying that the platform has a lot of what I’ve been looking for and solves many of the gripes I have with the Sharky UI. Some of my many favourite features include:

- The ability to place more than 3 offers at once and revoke all offers at once is an absolute godsend.

- The ability to sort collections Volume, APY and LTF makes looking for good loan plays infinitely easier.

- The ability to favourite collections that you like loaning against the most so you can cut out all the noise.

- Automated history of your loan activities for easier record keeping

- Analytics on multiple levels such as:

- The Collections –> statistics across multiple platforms, default rates etc.

- Other wallets –> see the habits of borrowers such as default rates

- A live feed of loans being taken. Imagine being able to see a single wallet borrowing against a certain collection, looking into that wallet and seeing they’ve got several of those NFTs and having the opportunity to offer a loan that they can take right away.

Even more impressive is that this is constantly evolving with Dave constantly adding features and making adjustments based on user feedback. At the end of the day, the user experience is being prioritised. I personally requested a feature whereby the live feed of loans could be filtered to only show collections that I have favourited. It was added within 24 hours. Unreal.

The NFT

If I’m being honest, this is where I’m not as sold BUT it’s less about what value I get as a holder and more about the business model for the project. One of the biggest benefits of having an NFT collection is creating the community and the marketing potential that comes with it BUT it also creates a sense of obligation to your holders to provide them with value, otherwise you end up with a salty community that’s hard to please. The cost/benefit there can become problematic.

My main question mark on this matter is from the perspective of sustainability and revenue. The NFT collection, whilst potentially providing a large upfront lump sum of funds, only generates ongoing revenue from royalties. Whilst the upfront sum can provide a decent runway to begin with, you can only really do it once and then you need to look for revenue elsewhere to extend it. Royalties relies on having trading volume which can be difficult to stimulate as a utility project where the main purpose is to buy, hold and then use the tools you want to. Furthermore, the gating the entire platform behind the NFT limits your customer base which seems like such a waste for a platform I strongly believe can attract users.

With a platform as fantastic as this, I would have personally thought it would be a better idea to completely do away with the NFT, have it open to everybody to use, but charge a small fee for transactions on the platform. Microtransactions can be extremely powerful if there is enough volume going through the platform and I personally have no problem paying an additional fee for how Lender Labs makes my loaning experience significantly smoother and faster.

Alternatively, a middle ground could be to have it open to the public for use but gate certain desirable features behind the NFT such as the automation or notification functions. That way you would be able to encourage users to come use the site and test it out before committing to buying an NFT to get full access. Basically a ‘try-before-you-buy’ kind of scenario. It might be harder to convince someone to buy an NFT to gain access to something they have zero experience with.

The Moat

One of the biggest long-term challenges with a utility project like this is its ability to capture market share and maintain it. In a space where copy + paste jobs are a regular occurrence, Lender Labs need to make sure they’re staying ahead of the game to ensure new competitors don’t emerge offering the same services.

I believe this is especially an issue if somebody else builds the same kind of platform but offers free access but with microtransactions. I would much rather go to that platform where there is no upfront financial obligation in buying the NFT and I can just pay as I go.

Summary

Overall, I absolutely love the platform and the user-driven process that has brought it to life and made my loaning experiencing much easier. From a business standpoint, I do believe the project are potentially selling themselves short by tying themselves to an NFT and limiting their customer base unless they can find a way to generate revenue sustainably outside of royalties alone.