Frakt – Banx

About Frakt – Banx

FRAKT is a DeFi x NFT protocol looking to bring safe and accessible liquidity to NFT holders by providing services such as instant buy/sell and loans.

Current products include:

- Peer to Pool Protocols

- Can be perpetual or short-term

- More passive structure

- Lenders deposit SOL into a pool, earn a share in returns from the loan. No need to worry about setting loan details and competing with others but returns are significantly lower than P2P

- Borrowers have a pool of instant liquidity to borrow from. Loans can also be paid back early to reduce fees

- Interest rates determined by a combination of LTV% and % of the pool already locked up in loans

- i.e. Higher LTV = Higher Interest Rate, Higher Pool Utilisation % = Higher Interest Rate

- Perpetual loans will typically have lower interest rates but also lower TVLs

- Peer-to-Peer Loans

- Orderbook offers like on Sharky and Citrus

- Typically higher TVL which creates higher risk which typically means higher interest rates

- P2P lending also also opened up the creation of Bonds so lenders can sell their loans if they choose to do so

- Buy Now, Pay Later Mortgages (coming soon)

Existing Collection Details

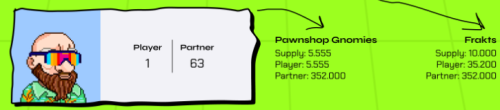

At present, the FRAKT ecosystem consists of 2 NFT Collections – Pawnshop Gnomies and FRAKT – as well as an SPL token $FRKT.

There also exists 2 points systems, Player and Partner Points.

- Pawnshop Gnomies

- 5555 Supply

- All have 1 Player Point and 63 Partner Points

- FRAKT

- 10K Supply

- Player and Partner Point distributions vary across attributes. Points are displayed amongst the traits

- $FRKT

- Pre-IDO token for $FRAKT

- Will be exchanged at the $FRAKT IDO at a rate of 1:62.5 with a 1 year linear vesting

Consolidation into BANX

Banx are the third collection from FRAKT but represent a merge of the existing collections into one. With a total supply of 20K, it will be distributed as follows:

- 10K to be minted from FRAKTS at a 1:1 ratio

- 5555 to be minted from Gnomies at a 1:1 ratio

- 4445 new Banx to be minted in SOL @ 10 SOL each

Player and Partner points from the FRAKT and Gnomies collections will be converted and applied to the new BANX that is minted from it. The Gnomies and FRAKT NFTs will also be stored for a period of 1 – 2 years and then returned to holders as collectibles.

No indications yet as to what will determine the Player and Partner points for BANX NFTs that are minted not from the old collections. It would also appear that the player and partner points assigned to the NFTs are fixed.

Mint Funds will be allocated as follows (amounts assuming full mint out in brackets):

- 70% going into Protocol Owned Liquidity (31 115 SOL)

- Funds to be put into the various lending strategies available on the platform with profits to be either compounded or assigned as protocol revenue to be distributed as part of the passive income system. This will be voted on by governance at each epoch.

- 10% going to fund BANX AMM pools on Hadeswap and Tensor (4445 SOL)

- 20% to Team Runway (8890 SOL)

$FRAKT IDO

The expansion of the FRAKT protocol also sees the introduction of $FRAKT token.

Current details on tokenomics are:

- 10B total supply

- 6.25% (625M) allocated to $FRKT holders at a ratio of 1:62.5 with a 1 year linear vesting period

- 5% for the IDO

- No information about the remaining 88.75% so far

- It has been mentioned that some will go towards paying User Rewards for engagement with the project

40% of the total Player and Partner points will be allocated to staked $FRAKT holders as well. No information has been released yet on how this distribution will work.

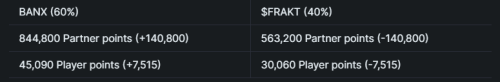

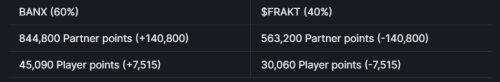

Most utilities tie into the Player and Partner points system. The distribution of points between BANX NFTs and the $FRAKT tokens are as follows:

Player Points

Player Points represent the ‘premium’ user status on the FRAKT platform with the following benefits:

- Each player point earns you a 1% discount on borrowing fees on Flip Loans. It is possible to reach 100 player points to earn you a ‘fee free’ loan

- The current borrowing fees on Flip Loans are 1% of the loan value

- 1 free raffle ticket per day for the raffles on liquidated NFTs per player point

- Any unused player points are burned at the end of the day

Partner Points

Partner Points represent governance within the ecosystem and:

- Determines your share in the passive income system

- Rewards from the Passive Income System are paid in $FRAKT

- Determines your voting power on things such as allocating profits from the protocol owned liquidity

$FRAKT Benefits

Staked $FRAKT yields the same benefits with accordance to the Player and Partner Points system however, there is no information yet as to how those points will be distributed to $FRAKT stakers. Whether or not it is a fixed ratio or dynamic based on a percentage of circulating supply that is staked remains to be seen.

Additionally, $FRAKT stakers will be able to earn $HADES rewards at a rate of 0.001332 $HADES per $FRAKT staked which will be emitted over a period of 18 months.

The Passive Income System

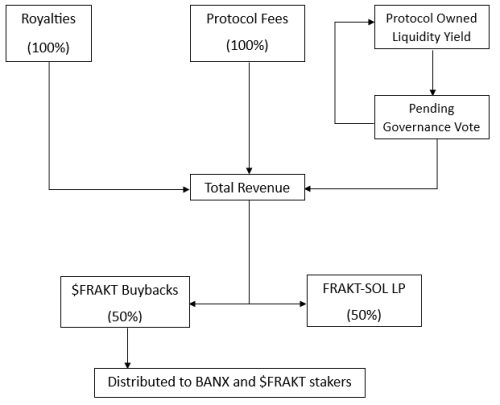

To the best of my knowledge, I have created the following infographic outlining how the Passive Income system is funded.

Revenue from royalties, protocol fees and the Protocol Owned Liquidity (pending governance vote) are consolidated. 50% of these funds are allocated to buying back the $FRAKT token which is then distributed to BANX and $FRAKT stakers. The other 50% is used to fund a liquidity pool for the token.

Note that there will be a period of time after the BANX mint before the $FRAKT token launches. During this time, 100% of the revenue will be distributed to BANX stakers as SOL.

Rewards are distributed via FRAKT’s Gamified Staking

Staking

FRAKT’s staking mechanism will involve holders sending their BANX NFTs out on weekly adventures. It is important to note that this cannot be automated and requires active participation. That being said, adventures can be chosen 2 weeks ahead of time to allow some leeway to those who may be busy. Any unclaimed rewards will be used to buy back BANX NFTs which will be distributed as rewards.

Through the adventures, holders will earn 2 Loot Boxes.

- Box 1 will contain their share of that week’s passive income paid in $FRAKT token

- Box 2 will contain bonus rewards of varying probability ranging from BANX NFTs, Whitelist Spots, other NFTs, discounts etc.

Timur

- Founder

- Twitter: @timsamoylov

Vedapunk

- CTO and Co-Founder

- Twitter: @vedapunk_sol

Marshy

- Community, Social and Partnerships Manager

- Twitter: @marshy_sol

Egor

- UX/UI Designer

- Twitter: @Egor_Russak

Franky

- Head of Growth

- Twitter: @frankyfrakt

FRAKT Protocol

I’ve had the opportunity to play around on the protocol and whilst initially quite complicated, found that it lends itself to numerous strategies once you know how to navigate them. Admittedly I’m quite basic when it comes to NFTFi, preferring to use Sharky for its simplicity so starting on FRAKT was initially a tad overwhelming.

To summarise the best of my current understanding:

- Pools offer a more passive system. You deposit your funds and you can walk away. No need to compete with other lenders. No need to worry about loans going underwater. The trade-off for such simplicity is that:

- Interest rates are determined by how much of the pool has been utilised which at present, is about 30 – 35% for most pools. Based on their infographic, the interest rates don’t really rise substantially until that 65% mark is hit. As such unless there is large demand for loaning, the interest rates are low.

- Furthermore, it appears that on perpetual loans, the maximum TVL somebody can borrow against their NFT is 40% which lowers the principal value.

- The returns from the loans are then distributed evenly based on what percentage of the pool contribution is yours. As such the overall returns are lower.

- Peer-to-peer lending is what I’m more familiar with where you are more actively involved in setting the terms of the loan and waiting for someone to accept your offer. As far as I can tell, borrowers are able to acquire a higher percentage TVL against their NFT compared to pool loans. This of course means higher risk to the lender who in turn can set a higher interest rate. Their ability to automate this function is also very appealing.

I do however, have a couple issues with the current UI:

- In order to see available terms for borrowing against an NFT, I must hold it in my wallet at the time. As someone who likes to keep his NFTs in separate wallets, it becomes a point of friction that in order to see what terms I can get, I need to move the NFT into the wallet that I am using on FRAKT. It would be useful for borrowers to be able to see the available terms across all collections without having to hold the NFTs.

- The platform currently shows interest rates either as an APR or the rate for the duration of the loan. It would be useful to have this displayed as an APY so that terms can be compared across platforms without having to do the maths of converting it.

Overall, it is probably an appealing platform for more nuanced lenders or people wanting extremely passive systems. That being said, the yield on the passive systems aren’t that impressive compared to what else is out there. What that leaves is more nuanced lenders and as a general rule, the majority of people in the ecosystem prefer simplicity.

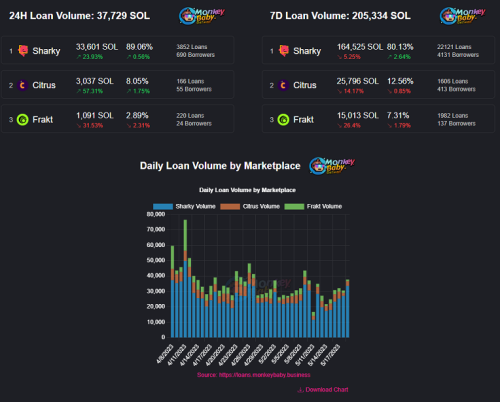

I believe this is reflected in the following image taken from Monkey Baby Business‘ analytics comparing the volume across the three major lending platforms.

The Collections

My initial thought with this is that there is way too much going on. Even with consolidating FRAKT and PG into Banx, having an SPL token in addition to two points system was very difficult for me to navigate, especially with all the different ways they interplay. It would not surprise me if other people feel the same way when trying to navigate this ecosystem but I hope my summary here offers some assistance.

Banx and $FRAKT both playing a role in FRAKT’s utilities opens the toss-up for newbies between whether or not they get skin in the game by purchasing an NFT or the token – but then that begs my next question…

Why?

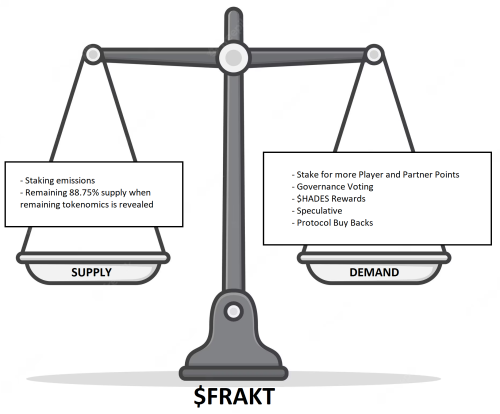

Why $FRAKT?

Given that both BANX and $FRAKT play a role in the platform’s utilities (with the only difference being $HADES rewards), it essentially means that $FRAKT is diluting the BANX collection without being an NFT. Even with the $HADES rewards being a differentiating factor, the earn rate is low and slow.

Furthermore, the introduction of $FRAKT not only introduces a headache for uses to navigate what role it plays in the ecosystem, it also creates a headache for the project as they try to sustain any meaningful value on the token.

For an SPL token’s value to be sustainable, what it requires more than anything else is use cases that motivate people to hold/use it more than they want to sell it.

- Realistically, the only genuine use cases are:

- $HADES rewards but I don’t know if the earn rate is really that enticing. It’ll come down to how much it costs so that your $HADES earn rate is meaningful

- Player Points

- 1% discount on a 1% of loan value borrowing fee is bugger all. How many player points and loans do you need to be taking out for that to be worthwhile

- Raffle tickets sure but with a total of 75K+ player points in circulation, I don’t fancy my chances

- Partner Points

- I personally don’t care a whole lot about governance. Most of the time it gets taken over by larger holders anyway

- Earnings from passive income

- The problem with this is using earned $FRAKT to stake for more $FRAKT is ok up until the point I need something else to do with it. Otherwise I start to sell.

Based on the above, I’m not convinced there is enough appealing use case for the $FRAKT token which inevitably means immense sell pressure that needs to be dealt with, especially considering we don’t know where a large portion of the remaining supply will be allocated to.

That means it is heavily dependent on the buy-backs of the token to prop-up its value. The funds for this are tied to the performance of the platform and based on my experience with it, I don’t see it outperforming Sharky or Citrus any time soon. Add in that Dimenzions are coming out with their own product, competition in the market is going to be tight.

It is my personal belief that all of this headache and confusion would be simplified by completely doing away with the $FRAKT token and instead just paying SOL out to holders as their rewards. I believe people would prefer to earn their rewards in SOL over an SPL token any day of the week.

The only other reason I can think of that the team wishes to introduce the token, is so they can use it as a fundraiser through the IDO. But then that begs the question, what do they need the funds for? How much are they looking to raise? Where will those funds be going?

Running Some Numbers

Mint Revenue

Consolidation of their collections into one makes sense. That’s fair enough. My questions lie in the additional supply (4445 NFTs) being minted at a cost of 10 SOL each. Given that they’ve had previous collections before and earn revenue through their platform, one would assume that the majority of this would be getting allocated to their runway for expansion of their platform; but this is not the case.

Instead, 70% is being allocated to Protocol Owned Liquidity. I’m curious as to why the team feels the need to allocate such a large percentage of their funds to propping up the liquidity on their platform especially given that the utilisation rate across their existing loans is very low. Furthermore, such an action would create more unfavourable environments for individual lenders who now have to compete with the POL for a share in the lending pools or on peer-to-peer lending terms.

The next 10% goes to funding an AMM for the BANX NFT which is said to guarantee post-mint liquidity which is fair enough. The double-edged sword though is that increased liquidity typically stabilises price action. By launching an AMM so soon, it limits the potential for price discovery immediately post-mint. Perhaps their motivation is less about floor price and more about earning royalties.

That leaves 20% of the mint funds going towards their runway with no reference to what those funds will be used for.

The combination of expanding the collection, charging a fairly steep mint price for the additional supply and then most of it being allocated to POL makes very little sense to me. Add in the fund raise through the $FRAKT IDO and I just have even more questions.

Possible Earning Projections

I ran a very basic simulation based on the statistics from the Monkey Baby Business infographic above. At the time or writing, the 7d volume on Frakt totals 15K SOL.

Let’s assume best case scenario here. The largest upfront fee across Frakt’s loans are 1%. For this exercise, let’s assume every loan maxed that fee. The difference between the variable borrow rate for borrowers and variable deposit rate for lenders is charged as a loan fee by Frakt as well which is around the 15 – 20% of the borrowing interest rate. Let’s be overly generous and say this earns Frakt another 1% on the value of the loan.

This means that on a total of 15K SOL, Frakt has earned 300 SOL in Protocol Fees.

There is a total of 1,408,000 Partner Points in the system which yields 0.0002 SOL per partner point. All Pawnshop Gnomies carry 63 partner points. This yields 0.0126 SOL per week. Extrapolating this across 1 whole year yields 0.6552 SOL per annum. At a current entry of 10.8 SOL, that’s a yield of 6% per annum.

Granted, this is not factoring in potential for increases in volume on the marketplace as well as royalties being paid out but as you can imagine, the difference these factors need to make for this to be worthwhile is enormous, especially considering the rewards are paid in $FRAKT which will struggle with sell pressure. I’d much rather just deposit my SOL into the pools and not have to deal with the headache of NFTs and SPL tokens.

Covering Costs

Lastly on the topic of numbers, promising 100% of Royalties and Protocol Fees being paid out to holders zero ongoing revenue for the Team to both pay themselves and to grow their treasury and runway. So my question is where is their ongoing revenue coming from to keep growing their project, cover running costs and pay themselves?

Couple More Questions

- With the old collections retaining their points when they convert to BANX, what will determine the point allocations to the newly minted BANX NFTs? What especially confused me is that in the below image from the whitepaper, it states that the supply of allocated Player Points to BANX NFTs is 45090.

In another infographic on the mint details page, it states that the total Player Points assigned to PGs is 5555 and FRAKTs is 35200.

In another infographic on the mint details page, it states that the total Player Points assigned to PGs is 5555 and FRAKTs is 35200. This gives a total of 40755 Player Points already allocated. This leaves a remainder of 4335 Player Points to be distributed between 4445 new BANX NFTs. Doesn’t quite add up there.

This gives a total of 40755 Player Points already allocated. This leaves a remainder of 4335 Player Points to be distributed between 4445 new BANX NFTs. Doesn’t quite add up there. - Will there be a portion of the $FRAKT supply allocated to BANX holders when the IDO comes – whether it be a free airdrop or pre-sale allocation?

- Given that the gamified staking for the BANX NFTs involves going on adventures to redeem rewards, what will the mechanism be for those staking $FRAKT?

General Notes

- Declaring passive income as guaranteed and sustainable is a very risky idea as you immediately train your holders to think that they extract value from the tokens they earn by selling it.

- As far as I can tell, the team are not doxxed. Yes they are one of the OG projects in the space, but that doesn’t mean a whole lot if you haven’t become synonymous with the space during that time.

- I do like that their system encourages active engagement through both the staking rewards as well as making sure your raffle tickets don’t go to waste.

Conclusions

Personally, FRAKT poses more questions at this stage that I would need answers on before committing.. The platform itself certainly lends itself to more nuanced lending, but it is challenging to navigate which I believe hinders their ability to grab market share and bump up activity. The success of the project, especially in terms of buy backs and yield paid to holders is heavily dependent on the performance of the marketplace.

The ecosystem involving NFTs, an SPL token AND points introduces friction to newbies who will struggle to navigate what does what and how it all ties together.

The introduction of $FRAKT also poses many questions in terms of why it is even necessary in the first place given the headaches it creates.