About Bake DeFi

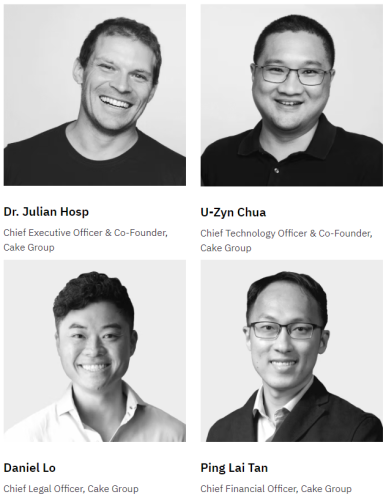

Bake was founded by Dr. Julian Hosp and U-Zyn Chua in 2019. Their aim is to provide an easy-to-use platform that aggregates various DeFi applications and services and is accessible to crypto investors around the world.

Bake stands as a comprehensive crypto application designed to cater to users of all levels, from novices exploring the realm of cryptocurrency to seasoned experts. Its essence lies in its user-centric design, boasting an intuitive interface, easily digestible products, and a welcoming onboarding process, ensuring a seamless user experience.

Security:

What truly distinguishes Bake is its commitment to security and transparency. Bake employs cutting-edge security features and practices to safeguard users’ financial assets and sensitive information.

Customer funds are securely stored and protected in cold wallets with strict multi-sig security policies to ensure customer funds cannot be accessed without the approval of multiple parties, reducing the risk from a single point of compromise. Customer assets are also kept separate and properly isolated from the company’s operational funds meaning they will never use your funds without your direct and specific instructions.

Bake makes everything clear and easy to see. The following are some of the ways they provide transparency to their users:

- They boast 99.9% uptime on all their services along with 99% of all withdrawals fulfilled within 24 hours. This information is available on their website at https://status.bake.io/

- Users are able to verify wallet addresses, smart contracts and other on-chain data on their website https://bake.io/transparency

- Quarterly Transparency Reports are released to the public with metrics on reward payouts, company operations, financial health, team performance and much more.

- Bake provides Proof of Reserves & Liabilities. Proof of Reserves is a way of showing that institutions or exchanges can always fulfill the requests for withdrawing money from their platforms. Unlike most CEXs that don’t provide proof of funds, Bake allows users to check that its on-chain funds are sufficient enough to cover its users’ liabilities without solely relying on government-issued licenses or audits (which can often be unreliable).

What Services Do Bake Offer?

The current services that their Retail arm offers are Staking, YieldVault & Liquidity Mining. The other arms of their company cater to Institutions, Research & Development and Venture Capital.

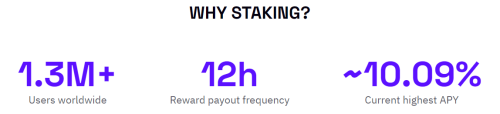

What is Staking?

Staking is essentially when you put your cryptocurrency to work to help keep a blockchain network safe and running smoothly.

This is suited for a more intermediate-level crypto investor and is a great way to earn some ‘interest’ on the crypto they would otherwise be holding in their wallets.

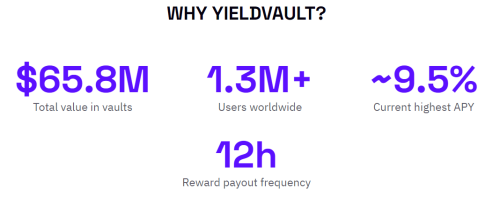

What is YieldVault?

YieldVault is a beginner-friendly service that makes generating passive income simple and hassle free.

All you have to do is allocate your crypto and choose your rewards and it automatically starts generating passive income for you. Everything is completely transparent giving you total control over your assets.

What is Liquidity Mining?

Liquidity Mining allows users to receive rewards by providing liquidity to a decentralized exchange. It is mostly suited for advanced-level crypto investors.

Imagine you have some money, and you want to help a particular cryptocurrency platform. In return, they’ll give you some of their own cryptocurrency as a reward. This is like a thank-you gift for helping them out.

But here’s the twist, you’re not just giving them your money to hold onto. You’re lending it to them so they can use it for various things. One important thing they do with your money is to let other people trade and do stuff with it on their platform.

Now, because you’re letting them use your money, they want to give you a piece of the action. So, they give you some of their cryptocurrency at regular intervals. This process is called liquidity mining.

It’s a way for you to earn something extra while helping the platform run smoothly. Before using Liquidity Mining ensure that you understand the risks of Impermanent Loss.

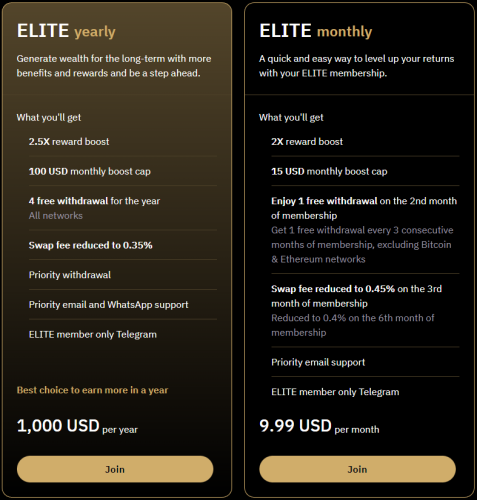

What is ELITE?

ELITE is a subscription club for the more serious crypto investors. The membership gives access to amazing benefits and returns that are otherwise unavailable to regular Bake users.

Dr. Julian Hosp – https://sg.linkedin.com/in/julianhosp?trk=org-employees

U-Zyn Chua – https://sg.linkedin.com/in/uzynchua?trk=org-employees

Daniel Lo – https://sg.linkedin.com/in/danlo?trk=org-employees

Ping Lai Tan – https://www.linkedin.com/in/ping-lai-tan-66a277b6/

Bake has over 180 employees from all around the world.

My Thoughts?

Initially, this platform looks very appealing. Let’s have a look at some of the positives:

- It’s based in Singapore, a country with a good reputation in the space.

- It’s a large organization with 180+ employees based all around the world.

- They have a great presence on social media.

- Their security protocols seem second to none.

- They are much more transparent than most other platforms around.

- They offer competitive rates.

- They have a great user interface that’s simple and easy to use.

Pretty much everything an investor would want in a DeFi platform, right?!

When I dig a little deeper though, I stumbled across a few red flags….

Dr. Julian Hosp, the CEO of Bake, has been tied to controversial scams involving Lyoness & TenX. Now, I am not one to judge somebody purely off what I read on the internet as it’s very hard to determine the facts. I don’t see any reason for Julian to scam other people….I mean the guy is a Doctor!

But one thing that was a huge concern for me was the use of the cryptocurrency DeFiChain (DFI) and the stablecoin DUSD.

Julian Hosp & U-Zyn Chua are key figures in DeFiChain which is a blockchain platform built with a mission of maximizing the full potential of DeFi. This is the platform used by Bake.

DUSD is the stablecoin of the DeFiChain ecosystem. Bake also offer it in their ‘Borrow’ service allowing users to take loans out in DUSD.

DFI & DUSD are both promoted and used heavily in the Bake eco-system. Users who choose to receive rewards in these native tokens are rewarded with higher yields and both cryptos are required to partake in the Liquidity Mining.

The thing that I don’t like about this, is the fact that for the last year DUSD has not held its peg at $1.

The point of a stablecoin is to hold the value of $1 USD. The current price of DUSD is $0.38 and has been that low for a few months. Now why would anyone want to use or take out a loan in a stablecoin that isn’t stable?

Yet DUSD and DFI are promoted and pushed all over the Bake website and social media.

If DUSD was to eventually fail that would have catastrophic consequences for DeFiChain and subsequently the Bake eco-system.

This is a huge red flag for me and is certainly enough to deter me from using the platform no matter how secure and transparent it claims to be. Look at what happened to LUNA when UST collapsed. Could the same happen to DFI and DUSD?

In conclusion, I do like the security and transparency of the platform, the team look solid and they have a 5+ year runway but the fact that Bake continues to push DFI and DUSD even though it has lost its peg to the dollar is enough for me to sit on the sidelines.

I will keep an eye on the platform to see if DFI & DUSD can recover and return to normal but until then ill look elsewhere.