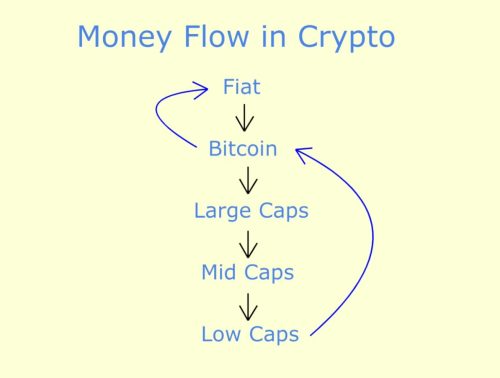

Market cycles are a major part of any financial market, and crypto is no exception. Most people think of market cycles in crypto as the macro bull and bear markets, but they occur on all timescales. Taking it one step beyond market cycles, we can look at money flow, which can be thought of as a more granular look into a market cycle. One way to visualize this is using the image below.

This graphic shows a more specific flow of money within a market cycle. Here, the black arrows pointing down would indicate a bull market as money goes from fiat currency into cryptos. And the blue arrows pointing upward indicate a bear market as money goes from cryptos back to fiat currency.

The added granularity in money flow is that it shows a few additional steps within the bull market, such that the flow of money typically starts by going from fiat to Bitcoin. Then it trickles into other cryptocurrencies, typically starting with larger cap cryptos and ending with the smaller, low cap coins. Meme coins typically fall under the low cap category as well, even if some of them do have larger market caps. Another way to view this money flow diagram is that money flow goes from less risky assets into more risky assets, before the cycle starts to repeat back to fiat.

2021 Bull Market Examples

Near the peak of the 2021 bull run, low caps and meme coins were getting the cash flow. There are many out there that didn’t survive (as most do not), but one thing that tends to be common in these meme coin seasons is that there is always a theme to the ones that receive the most hype and cash flow. The 2021 season was a season of dog-themed coins such as DOGE, SHIB, FLOKI, KISHU, and ELON just to name a couple.

Let’s look at a couple of the charts from these coins and see how they overlap with Bitcoin.

*Note: For each chart below, BTC is shown on the top pane and the meme coin is on the lower pane.

DOGE:

While Dogecoin rallied a couple times during the bull market, the push from DOGE was over a 10x move and overlaps nicely with the first major BTC pullback where it dropped over 50%.

SHIB:

Shiba Inu was a product of the Dogecoin hype and as such, it got it’s turn at meme coin season on the last impulse of the 2021 bull market. Again with the chart below we can see SHIB really had its explosive money flow at the second peak of BTC rally. Where within a week afterward, BTC started what will later be known as the beginning of the bear market.

And ELON and KISHU follow a very similar track as well, as seen below.

Before moving forward, it is worth noting that there are many more examples of this happening, but most of these coins completely die and I am unable to even find a chart for them to share.

Relevance to Current Market

We are in the heart of a meme coin season currently. It’s nearly impossible to avoid on social medias as everybody is trying to shill whatever garbage coin they have bought so they can flip a quick profit. While the 2021 meme coin season was sparked by the Doge meme, this round seems to be hyped around the Pepe meme. With the $PEPE token being one of the larger meme coins to pop. From there we have seen a couple derivatives of the Pepe theme as well as a series of Cinco de Mayo theme coins ($CHIPS, $GUAC, etc.) as that holiday was simply relevant at the time of meme coin season. This all fits the narrative of a standard meme coin rally.

PEPE:

This chart doesn’t have much data for PEPE because it’s a newer token, but it does show a bit of similarities with BTC price action. We can see BTC has had nearly a 2x move upward and are now seeing meme coins get some money flow.

This all feels very similar to how we know money flow in the crypto markets work. Here we are following this money flow pattern again. BTC seeing nearly a 2x in price action in a couple months. Many mid and large caps have performed reasonably well although they did not see a massive cash flow like major bull runs. But we can definitely see the current narrative for the crypto market is meme coins (low caps). We are seeing this very high-risk nature in cash flow as BTC remains steady.

Is Crypto About to Crash?

Well no, obviously it isn’t concrete as nothing in these markets is ever perfect. But if we are looking at very standard trends such as market cycle, money flow, fear-greed, and social media trends then this is certainly relevant because we have seen this narrative before. It is very standard for markets to move from low-risk assets to high-risk assets before removing the greedy players from the game.

Many people will take the opinion of “Well Bitcoin isn’t at all-time highs so this is invalid”. So I want to address this by reiterating something I mentioned at the beginning; market cycles occur on all timeframes. The main chart attached to this post shows an example macro market cycle of BTC on a chart using 2-day timeframe. Below I will show the same idea using the most recent 4-hour timeframe to give a perspective of how this could be possible in current market conditions.

This is simply an example to show that we may be looking at the low cap and meme coin money flow of a smaller market cycle like we see above.

Market Cycles and Money Flow

Market cycles are a major part of any financial market, and crypto is no exception. Most people think of market cycles in crypto as the macro bull and bear markets, but they occur on all timescales. Taking it one step beyond market cycles, we can look at money flow, which can be thought of as a more granular look into a market cycle. One way to visualize this is using the image below.

This graphic shows a more specific flow of money within a market cycle. Here, the black arrows pointing down would indicate a bull market as money goes from fiat currency into cryptos. And the blue arrows pointing upward indicate a bear market as money goes from cryptos back to fiat currency.

The added granularity in money flow is that it shows a few additional steps within the bull market, such that the flow of money typically starts by going from fiat to Bitcoin. Then it trickles into other cryptocurrencies, typically starting with larger cap cryptos and ending with the smaller, low cap coins. Meme coins typically fall under the low cap category as well, even if some of them do have larger market caps. Another way to view this money flow diagram is that money flow goes from less risky assets into more risky assets, before the cycle starts to repeat back to fiat.

2021 Bull Market Examples

Near the peak of the 2021 bull run, low caps and meme coins were getting the cash flow. There are many out there that didn’t survive (as most do not), but one thing that tends to be common in these meme coin seasons is that there is always a theme to the ones that receive the most hype and cash flow. The 2021 season was a season of dog-themed coins such as DOGE, SHIB, FLOKI, KISHU, and ELON just to name a couple.

Let’s look at a couple of the charts from these coins and see how they overlap with Bitcoin.

*Note: For each chart below, BTC is shown on the top pane and the meme coin is on the lower pane.

DOGE:

While Dogecoin rallied a couple times during the bull market, the push from DOGE was over a 10x move and overlaps nicely with the first major BTC pullback where it dropped over 50%.

SHIB:

Shiba Inu was a product of the Dogecoin hype and as such, it got it’s turn at meme coin season on the last impulse of the 2021 bull market. Again with the chart below we can see SHIB really had its explosive money flow at the second peak of BTC rally. Where within a week afterward, BTC started what will later be known as the beginning of the bear market.

And ELON and KISHU follow a very similar track as well, as seen below.

Before moving forward, it is worth noting that there are many more examples of this happening, but most of these coins completely die and I am unable to even find a chart for them to share.

Relevance to Current Market

We are in the heart of a meme coin season currently. It’s nearly impossible to avoid on social medias as everybody is trying to shill whatever garbage coin they have bought so they can flip a quick profit. While the 2021 meme coin season was sparked by the Doge meme, this round seems to be hyped around the Pepe meme. With the $PEPE token being one of the larger meme coins to pop. From there we have seen a couple derivatives of the Pepe theme as well as a series of Cinco de Mayo theme coins ($CHIPS, $GUAC, etc.) as that holiday was simply relevant at the time of meme coin season. This all fits the narrative of a standard meme coin rally.

PEPE:

This chart doesn’t have much data for PEPE because it’s a newer token, but it does show a bit of similarities with BTC price action. We can see BTC has had nearly a 2x move upward and are now seeing meme coins get some money flow.

This all feels very similar to how we know money flow in the crypto markets work. Here we are following this money flow pattern again. BTC seeing nearly a 2x in price action in a couple months. Many mid and large caps have performed reasonably well although they did not see a massive cash flow like major bull runs. But we can definitely see the current narrative for the crypto market is meme coins (low caps). We are seeing this very high-risk nature in cash flow as BTC remains steady.

Is Crypto About to Crash?

Well no, obviously it isn’t concrete as nothing in these markets is ever perfect. But if we are looking at very standard trends such as market cycle, money flow, fear-greed, and social media trends then this is certainly relevant because we have seen this narrative before. It is very standard for markets to move from low-risk assets to high-risk assets before removing the greedy players from the game.

Many people will take the opinion of “Well Bitcoin isn’t at all-time highs so this is invalid”. So I want to address this by reiterating something I mentioned at the beginning; market cycles occur on all timeframes. The main chart attached to this post shows an example macro market cycle of BTC on a chart using 2-day timeframe. Below I will show the same idea using the most recent 4-hour timeframe to give a perspective of how this could be possible in current market conditions.

This is simply an example to show that we may be looking at the low cap and meme coin money flow of a smaller market cycle like we see above.

History doesn’t repeat, but it often rhymes.