HTF Bitcoin Price Prediction

Our Entry price has now been hit. A run on sell side liquidity is taking place but do we have an entry yet? Not quite.

I still believe price could come down to our Daily Orderblock to scare longs out. Patience pays and confirmation is key.

I want to see price rally up on a smaller timeframe presenting my entry criteria. If we fall further to the Orderblock then im just waiting.

Price has not yet shown us a willingness to move up so until we can get that we are watching and waiting.

Apologize, been a bit slow updating this latest piece to the puzzle!

I wanted to illustrate how to find an entry using Fair Value Gaps (FVGs)

Previously we were waiting to see if price came down a little bit lower to try and dip into the Orderblock we had marked in blue. Price did in fact have another leg down but we just fell short of the Orderblock. Although we did sweep liquidity resting below the Equal Lows before continuing up. Lets break it down a little!

Confirmations:

- Price pushed below Equal Lows

- Price broke market structure showing a willingness to move higher.

- Fair Value Gap created

- Entry on the 2nd retest of the FVG as marked on the picture above which falls inside the New York Killzone (Time period between 7.00am – 10.00am NY time).

Notes –

- Before our break in market structure you could see price created another equal low alerting you that selling momentum may be coming to an end.

- Ideal entry was at a retest of the Orderblock but because we swept liquidity below our Equal Lows before breaking market structure and continuing up, that was enough.

- Entry could have been taken on the 1st retest of the FVG but adhering to the specific Killzone times for entry, the 2nd retest was an optimal entry.

This is how our set up looks like, currently sitting at 2.4:1 which is better than our minimum of 2:1

We have recently pushed above our Daily Swing High but since then price has not shown us a willingness to move lower. Pair this with the current bullish news of multiple companies filing for BTC ETFs, i am comfortable leaving this long on.

Taking partial profits at this area would certainly not hurt but i will revisit this idea if we continue to pullback to around a RRR of 2:1

With 50% of our position removed at a 2:1 RRR as stated above, i am letting the rest of our position ride.

Price took out our previous daily high and started moving toward our +OB level which falls nicely below the previous swing low. This also lines up with higher timeframe liquidation levels.

As you can see below on the Hyblock chart, price has wicked into those levels but hasn’t quite taken it completely.

I am closely watching that 24k area incase price wants to come down for another stab at liquidity.

We have seen price take out previous daily high and come down to take out previous daily low so my next target for profits is going to be a further 25% of my position taken off at the new previous daily high with the final 25% at final target just under the weekly fair value gap.

Well its certainly been a while since my last post! Bitcoin had another stab into the Orderblock and drawing into some HTF liquidation levels before moving sideways for some time.

Recently over the past week we have seen some bullish price movement on Bitcoin coming off the back of some fake news about a BTC ETF. Fake news or not though, the market is responding positively!

We finally got our final push into our Weekly FVG. As I said in my previous post above, I was looking to take off 25% at the previous daily high but within a single 4 hour candle we pushed straight through that and to our final take profit!

The trade took longer than I expected, but a wins a win. On to the next one!

Since March we have seen BTC rally 59% to form a high at $31k. Since then we have had a slow sell off forming a common ‘Bull Flag’ retail pattern on the Daily timeframe.

Looking at this from a retail perspective we have had 5 touches within the formation and a nice double bottom form creating relative equal lows.

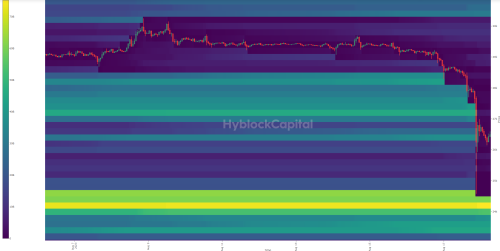

If we take a look at the image below we can see the current heatmap levels for Bitcoin.

At a glance you can see the sheer amount of liquidity that lays below current price as opposed to above it.

Now pair that with the equal lows formed within the Bull Flag and we have one hell of a liquidity pool sitting below!

What scenario do i want to see play out?

Well i still think BTC wants to go higher so in order to push price to my final target of $34k we need some major liquidity. What better place for price to draw on than our $25800-25200 level!

Ideally, we see price push down and sweep our relative equals lows and create an impulsive move to the upside confirming the willingness of price wanting to move higher.

I would expect a decent swing below to stop out any retail traders prematurely entering a long off this bull flag, so i have my stop loss a safe distance away resting below the Orderblock.

Once that happens i think we see quick movement from price reaching for our Weekly FVG at around $34k.

Final Take Profit at a 4:1 Risk Reward. Expected time for price to reach final Take Profit would be about 2 months.