Vtopia

About Vtopia

Update: 22nd October 2023

Major announcements were made in the Vtopia Discord explaining significant changes in structure to the team after initial delays to the marketplace launch.

A PDF (which has since been deleted) was put in the Major Announcements by Vtopian.sol outlining difficulties experienced by the Dev team to keep up with expectations, requests and deadlines from the Board and Council Members. The PDF outlined a willingness to open source the work they had done so far to facilitate a transition.

Announcements were then made in the Holders Chat by Mark indicating a decision to restructure the leadership of the project with Mark and Jerry taking over and the Dev team led by Vtopian parting ways amicably. The alluded to a lack of communication about whether or not deadlines could be met from the Dev Team.

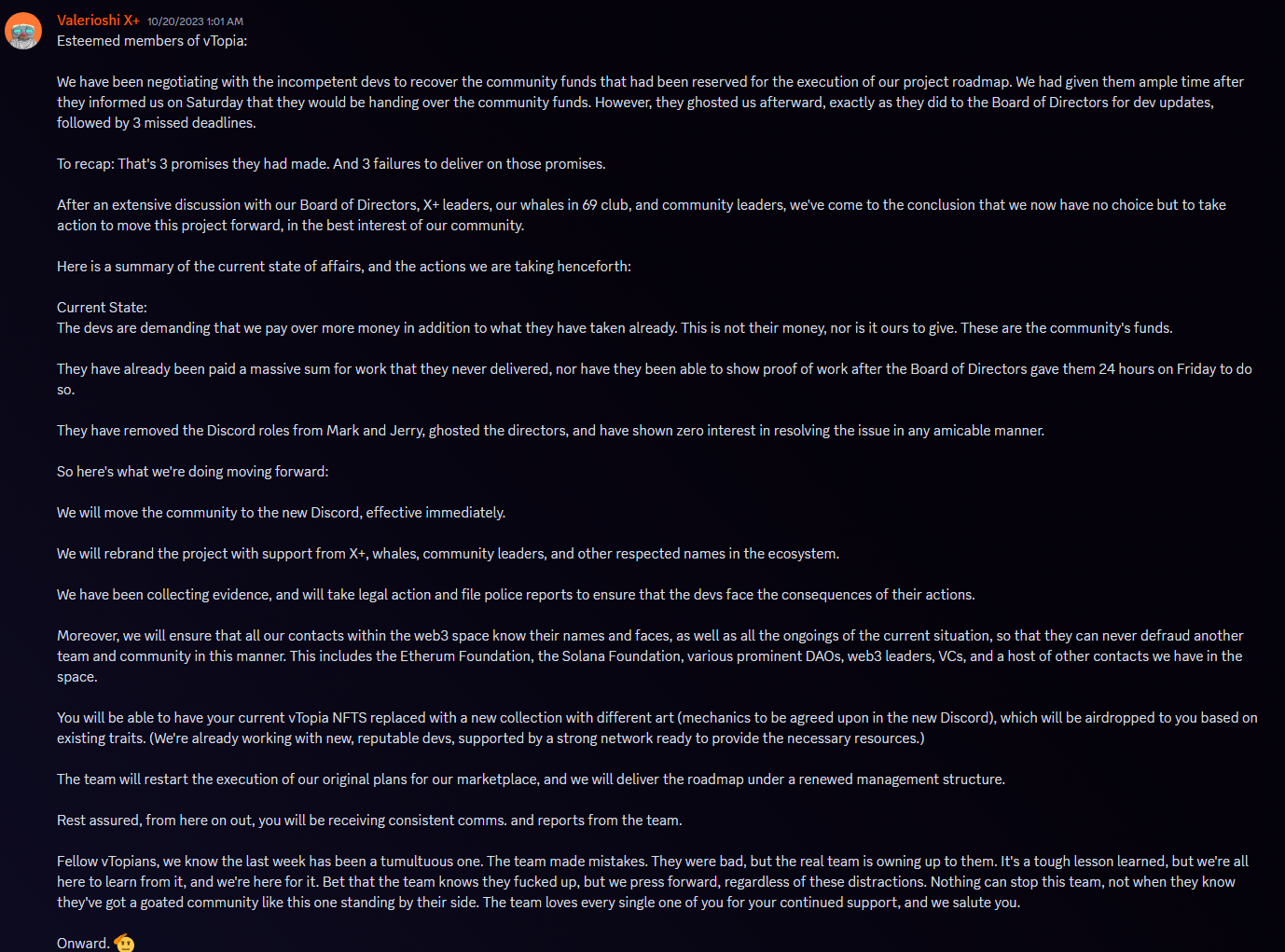

Subsequently, an announcement was made by Valerioshi in Holders Chat indicating that the separation has indeed not gone amicably after all with the Dev Team allegedly withholding project funds. He also noted that due to issues with Discord roles that the community would need to migrate to a new Discord and the collection would be rebranded with new art. Announcement can be seen below:

Overview

Vtopia is one of the products launched by Auxesia Venture Studio alongside other entities like Refrakt Protocol. Through their Omnichain Infrastructure, Vtopia seeks to create a unique and seamless multi-chain experience covering NFT trading, project launching and other essential features in the Web3 space.

The Collections

Gen 0 Monoliths

Monoliths represent the Gen 0 Collection for Vtopia at a supply of 222 NFTs.

Gen 1 Vtopians

Vtopians are the main Gen 1 PFP Collection for Vtopia at a supply of 7777 NFTs.

Certain traits also have specific benefits listed below:

- Crowns earn an additional 20% bonus revshare from Eratainment

- Gold Skins benefits have been amended from 0% marketplace fees to bonus revshare from Eratainment and Launchpad

- Ink Skins receive a 50% discount on marketplace fees

- 1/1s receive all of the above.

Products/Ecosystem

Omnichain Technology

Underlying Vtopia’s products is Omnichain technology, powered by Refrakt Protocol. The goal is to create a seamless multichain experience for users without the associated friction like bridging funds, keeping track of what network assets are on etc. Their gitbook outlines several potential use cases for their technology such as cross-chain NFT transactions.

Marketplace

At the forefront of Vtopia is their multichain marketplace. Whilst it hasn’t been launched to the public yet, it was completed in May and has been tested by members of the Vtopia council for the past 3 – 4 months. Public launch will happen on September 30th.

Purported features include:

- Solana and Bitcoin Ordinals coverage.

- Ethereum marketplace framework completed. To be launched mid-December

- Customisable UI/UX depending on a user’s preferences through various features and widgets

- Cross-chain features powered by Refrakt Protocol such as:

- Multi-currency transactions. Seller can select the asset they want to receive, buyer can select what asset they want to pay with and Refrakt Protocol handles the exchange

- Cross-chain transactions – e.g. purchase NFTs on Ethereum but pay via Solana

- Rewards mechanism for active traders via the $ERA token

- Partnership with SharkyFi to integrate their buy now, pay later feature

- Percentage of net revenue from marketplace fees to be distributed to NFT holders

Launchpad

Vtopia have partnered with Oncore Labs to deliver a state of the art Launchpad service with the Vtopia mint providing the perfect proof of concept.

Launchpad features include:

- Wallet integration

- Discord role gating

- SOL and other SPL Payment Options

- Raffle Minting

35% of net revenue from the Launchpad will be distributed to NFT and $ERA holders.

It has been announced that several projects are already in the pipeline for the Launchpad.

Sera AI

Sera is an AI Companion designed to assist traders through various functions such as:

- Real-time market analytics such as recent floor price movement, ratio of listed NFTs to supply

- Provide a direct line of communication between listers and potential buyers for price negotiation

- Gauge social media sentiment through analysis of not only volume of mentions but also the nature of comments being made

$ERA

Day-to-day trader benefits centre around their token $ERA and is available to both holders and non-holders. Users will earn vPoints through utilisation of the marketplace with $ERA being airdropped based on points accumulated. The $ERA LP will also be funded and backed by 28.5% of transaction revenue, 10% of net launchpad profits and more. The IDO for $ERA is currently set at November 30th with more information regarding use cases and tokenomics to come closer to the date.

Eratainment

Eratainment is a Gaming, Casino and Entertainment hub for Vtopia. The team have partnered with Degen Labs and W3Play to facilitate these features with a portion of revenue generated also going to NFT Holders.

Solana Spaces

This feature is currently on hold, however the Founder plans on opening a Solana Spaces location in India with an opening date target set following the launch of Vtopia’s marketplace. Future goals involve opening locations in Dubai and Singapore.

Note: This is not associated in any way with Drip Haus.

Future Products

Other B2B and B2C products in the pipeline such as:

- Auction House

- Solfyre – Social media platform within Vtopia where people can advertise and transact directly from the feed

- On-chain Credit Scoring system

- Headshot (Sniper Bot)

- O NFTs -a new token standard to facilitate frictionless trading and interoperability across blockchains powered by Refrakt Protocol

Utilities stated as at 19th September 2023

Gen 0 Benefits

– 3.5% of marketplace transaction fee revenue distributed to Monolith holders. Between 222 Monoliths, that is roughly 0.016% of transaction fees.

– 22.2% discount on marketplace fees

– Access to the Vtopia Council and beta access to new features

– No fee access to Headshot tool

– Revshare from Eratainment

– 25% of Launchpad revenue to be distributed between Gen 0 and Gen 1 holders with Gen 0 holders earning 4 times what a Gen 1 holder does.

Gen 1 Benefits

– 25% of marketplace transaction fee revenue distributed to Vtopian holders. Between 7777 Vtopians, that is roughly 0.0032% of transaction fees.

– 7.77% discount on marketplace fees

– Discounted access to Headshot tool

– Revshare from Eratainment

– 25% of Launchpad revenue to be distributed between Gen 0 and Gen 1 holders with Gen 0 holders earning 4 times what a Gen 1 holder does.

$ERA

Use cases to be announced.

Vtopian.sol

- Co-Founder/CEO

- Twitter: @souravsamantara

Mohsin Sid

- Co-Founder/CTO

- Twitter: @siddi_404

- Github: Mohsinsiddi

Mark

- Co-Owner and Chief of Growth and Strategy

- Twitter: @MarzzNyc

Jerry

- Co-Owner and Chief Operations Officer

- Twitter: @jerrykestel

Shashank

- Senior Rust Developer

- Twitter: @BeyondShashank

- Github: S03XY

Mohit

- Lead UI/UX Designer

- Twitter: @mohitnayak29

Madhav

- Content Curator

- Twitter: @Madhav_goyal_

PixelRainbowNFT

- Ambassador

- Twitter: @PixelRainbowNFT

Starlord

- CM & Partnerships

- Twitter: @starlord_nfts

Blooper

- CM & Partnerships

- Twitter: @bloop_sol

Rahul

- Senior Backend Developer

- Twitter: @0xRahul_215

Rohan

- Token Engineer

- Twitter: @RowRowRoUrBoat

Pravar

- Token Engineer

- Twitter: @0xPravar

Nabong

- Collab Manager

- Twitter: @__nabonggg

Maiden

- Community Manager

- Twitter: @itsmaiden_

Mizzle Fire

- Community Manager & Mod

- Twitter: @MizzleFireNFT

Mike Jagga

- Story Curator

- Twitter: @MikeJaggaNFT

Update: 22nd October 2023

For transparency, I have sold my NFT holdings. Unfortunately, I neglected to screenshot the announcements that were made in the Holders Chat rather than Announcements prior to selling but will endeavour to get that information. As far as I can tell, the issue was a lack of communication and operating on different pages. The Dev Team felt unreasonably pressured to build out things that weren’t part of the original plan such as the Ordinals Marketplace and the trait-based rewards. They alleged that they had not been consulted and had just been expected to create those functions. The business team had been operating under the assumption that the marketplace would be ready by September 30th and weren’t told it wouldn’t be ready until a couple days out. Ultimately, not ideal from all parties.

The hopes of an amicable split seemed dashed after Valerioshi’s post and the fact that legal routes may be sought to regain the funds.

The biggest question I have now is how is the relationship with Refrakt affected? Was that relationship via Vtopian.sol and Mohsin originally? Or was it through Mark? Given that a lot of the tech involved was being provided via Omnichain, I’m not entirely sure what the future holds at this point in time.

Initial Thoughts

Firstly, I must give enormous credit and gratitude to Mark for taking the time to jump on a call with me and answering my questions. Anyone who knows me will tell you that it is a cumbersome task.

My first impression looking through Vtopia was that there is a LOT going on. Marketplaces alone is a big enough challenge let alone at the scale they are looking to achieve. Then throw in the Launchpad and other products in the works and it is clear Vtopia is a gargantuan endeavour. This would typically cause me great concern as I generally prefer projects to focus their attention on just doing one thing and executing it at a very high level. That being said, Vtopia seem to have heavy backing with an extensive team and Auxesia. Whether or not they can cover so many bases and at a consistently high level remains to be seen.

The Marketplace

It’s hard to assess the marketplace given that it hasn’t been launched publicly yet, but based on the features listed so far, there are many things that I’ve personally been screaming out for that they are looking to deliver, especially the ability to transact with an asset of your choice.

That being said, such a function brings in a couple questions:

- What is determining the exchange rate? Say as the seller I wish to receive SOL, what determines how much a buyer pays if they wish to use USDC?

- Once the cross-chain features are live, how does the project manage liquidity on each chain? If someone pays for an NFT on Ethereum via Solana, a bridging process must exist for the the seller to receive their value.

I did pose these questions to Mark and unfortunately the technology involved is proprietary knowledge but it was all powered by Refrakt Protocol. I’d love to know more about how it all works, especially from a security standpoint given how many vectors of attack may be possible with multiple chains involved.

Sera AI

Let me preface this by saying that I am a massive stickler for detail. When I see the terms ‘Powered by AI’, I assume that AI is heavily involved in the base functionality of a system. That’s my interpretation at least. For the AI feature to then be more or less a support bot was admittedly a bit underwhelming but again, that’s down to my interpretation. That being said, there are some features I find interesting.

The first one is the direct line of communication between traders. There have been many times where I’ve seen an NFT listed and would have loved the ability to reach out directly to the seller to try and arrange a deal. Foxy Dings only go so far. The flip side to this though is what is stopping people from getting in touch and then just arranging to go OTC to circumvent royalties?

The other feature is having something to analyse social media activity and sentiment. I’ve written an article previously about gauging social media activity and sentiment and the correlations it can have to price action. Finding meaningful data to write this was a hard slog and even then, I didn’t have the information I would have ideally wanted. Having an AI tool to do this for me is an absolute dream.

Why the NFT?

So the biggest question I had was given how much funding has clearly already gone into building this all out, especially in comparison to the relatively small mint raise, why was an NFT necessary? Furthermore, why did the project choose to launch an NFT prior to the marketplace being live? I used the comparison with Tensor where their product had already been out and there was proof in the pudding before they brought an NFT into the equation.

The answer was to do with Vtopia’s go-to-market strategy. The NFT was less about the mint-raise and more about building a community that bought into the vision of what was being created and in doing so, having a user base ready to utilise the marketplace immediately on launch so they could hit the ground running in terms of transactional volume.

My scepticism here is more a reflection of the space in general whereby building a community that believes in you is all well and good, but they can turn on you very quickly if they don’t feel like they’re getting value which can be a very painful game to play. I also noted that revshare models tend to create an inherent mentality among holders of ‘what is it that I’m getting out of holding this NFT’.

The response I received was ultimately it was the team’s responsibility to manage this and put the onus on them to keep delivering value to their holders. The balancing act for them is that they get their desired benefit of attracting activity on the marketplace from day 1 which is the purpose of this endeavour. Given how important this is due to the existing competition, I don’t think that’s an unreasonable way to try and approach it. It presents vast challenges but I respect the team’s confidence in their ability to deliver what they want to and provide value to their holders. This brings me to the revshare model.

Running Some Numbers

Obviously, I’m a big numbers person and any revshare model is always going to attract ROI expectations and calculations to gauge this. Looking at just the marketplace, I decided to look at some historical stats to crunch some numbers.

In the past month, there was 1.08 million SOL in trading volume at an average of 36K SOL per day (data taken from SolSniper). At 1% net market fees (1.4% Taker – 0.4% Maker), that is 10800 SOL. Let’s assume Vtopia manages to capture 1/3 of trading volume so they’re roughly on par with MagicEden and Tensor. That comes to 3600 SOL in transaction fees.

At 0.016% per Monolith, that comes to 0.576 SOL for the month.

At 0.0032% per Vtopian, that comes to 0.1152 SOL for the month.

Comparing that to the peak of NFT trading activity from December 24th 2022 until January 24th 2023. That month saw 3.21 million SOL in activity. At 1% net market fees and 1/3 of trading volume, that’s 10700 SOL.

At 0.016% per Monolith, that comes to 1.712 SOL for the month

At 0.0032% per Vtopian, that comes to 0.3424 SOL for the month.

Taking into account that this is Solana only, I do believe the potential is there once other chain marketplaces, launchpad fees and Eratainment come into the equation. It is heavily dependent on the team’s ability to capture market share and deliver products at a high level.

$ERA

As a general rule, I am a sceptic until proven otherwise when it comes to SPL tokens given the challenges involved in sustaining meaningful value. That being said, I will not comment further until more information has been provided.

Partnerships

A point worth noting is that none of their existing partnerships involve allocations of NFTs but rather equity in the company itself. The team have stated they would rather allocate equity to VC partners than a portion of supply that is waiting to be dumped. Equity comes with different types of pressure that Vtopia will have to manage though.

Previous Associations

I’ve seen a lot of FUD circulating regarding associations to previous projects which the team were able to clarify.

The major one is to do with Hydra Labs given that Mark used to work there. One of the former owners of HydraLabs, Renji acquired the Hydra Launchpad as part of it’s dissolution through his own organisation OnCore Labs. I personally find the reputation that Hydra were serial ruggers completely unreasonable. Yes, some projects launched by Hydra ultimately failed, but that’s 99% of projects and I’ve never seen a launchpad be held responsible for that in the way Hydra have. I don’t see people giving MagicEden or TrustLabs grief for the projects that have been launched through them that ultimately failed.

Last Few Points

One thing I find promising is that they seem to have a very good moat to prevent copy pastas. Given a lot of this is being built on their Omnichain infrastructure, it’s not a simple task for a competitor to come along and recreate the features that Vtopia will be offering, especially from a cross-chain perspective. That being said, competition will be inevitable and it’s on the team to stay ahead of that.

Mark also commented that their current runway is sufficient for the next 8 – 9 months which I found very impressive given what has already been built. The fact that a large amount of infrastructure has already been built is always a good indicator for the team’s willingness to have their own skin in the game.

Ultimately the success for Vtopia heavily hinges on their ability to deliver their products at a high level and capture market share. The team seems to understand very well that a great product alone isn’t enough to do this and their go-to market strategy has played out quite well so far. Success is never guaranteed though and the team definitely have their work cut out for them.

In the interest of transparency, I did purchase a few NFTs following my call with Mark primarily as a speculative play on the team being able to deliver on their goals. This is however, a personal opinion and in no way financial advice. As always, I encourage everybody to do their own due diligence and formulate their own opinions.